WASHINGTON — The Space Development Agency wants to maintain open competition for future satellite development contracts in a way that strengthens its industrial base, but an agency official said today that ideal is proving more difficult than expected.

“We firmly believe that what we’re trying to do is create a marketplace and send a demand signal to the market that says, ‘We need X units in Y months on a launch pad,’ and everything we say fits that model. The problem is, we’re struggling a little bit to put our money where our mouth is, so to speak,” SDA Technical Director Frank Turner said during a March 21 panel at the Satellite 2022 conference.

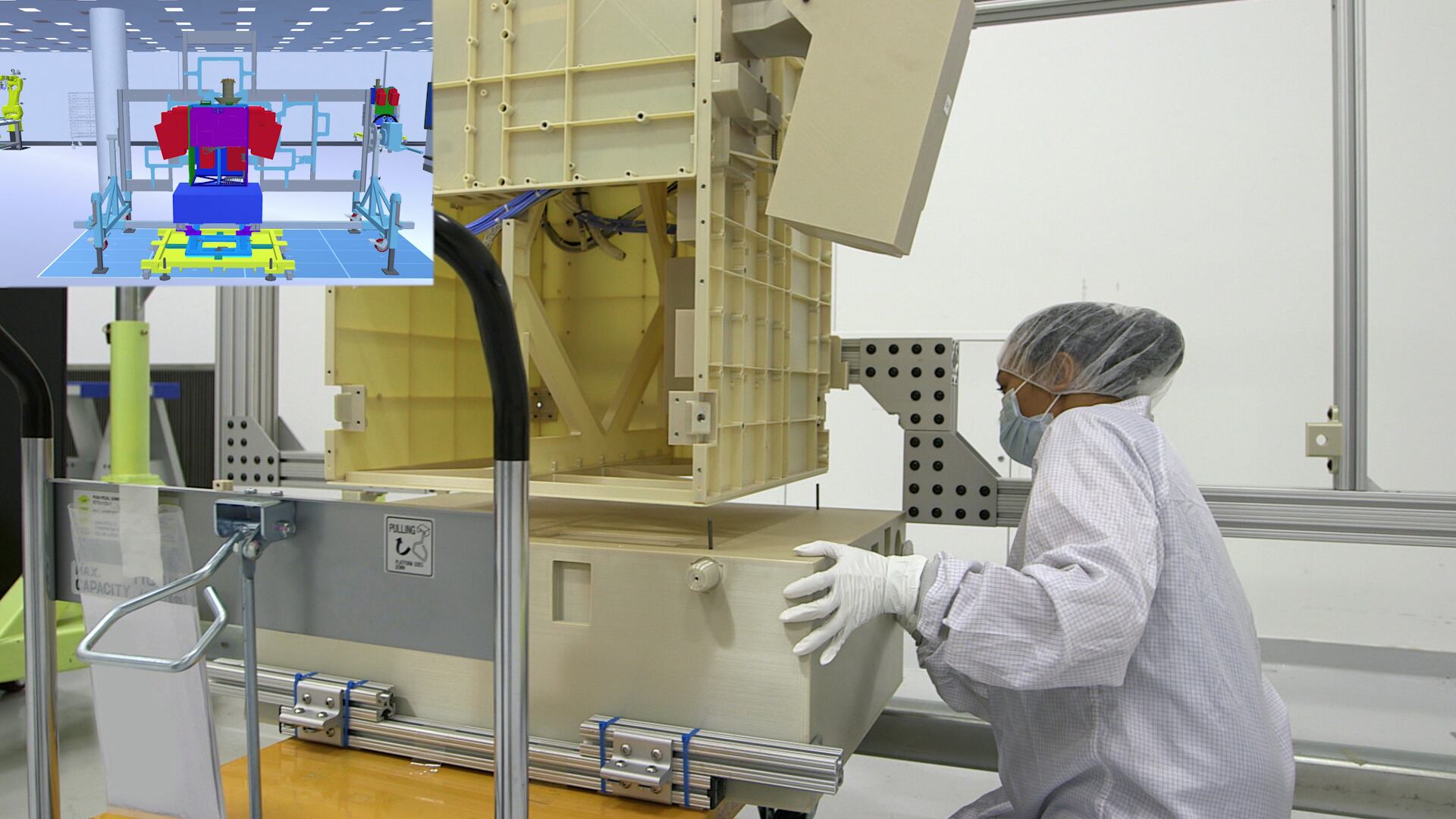

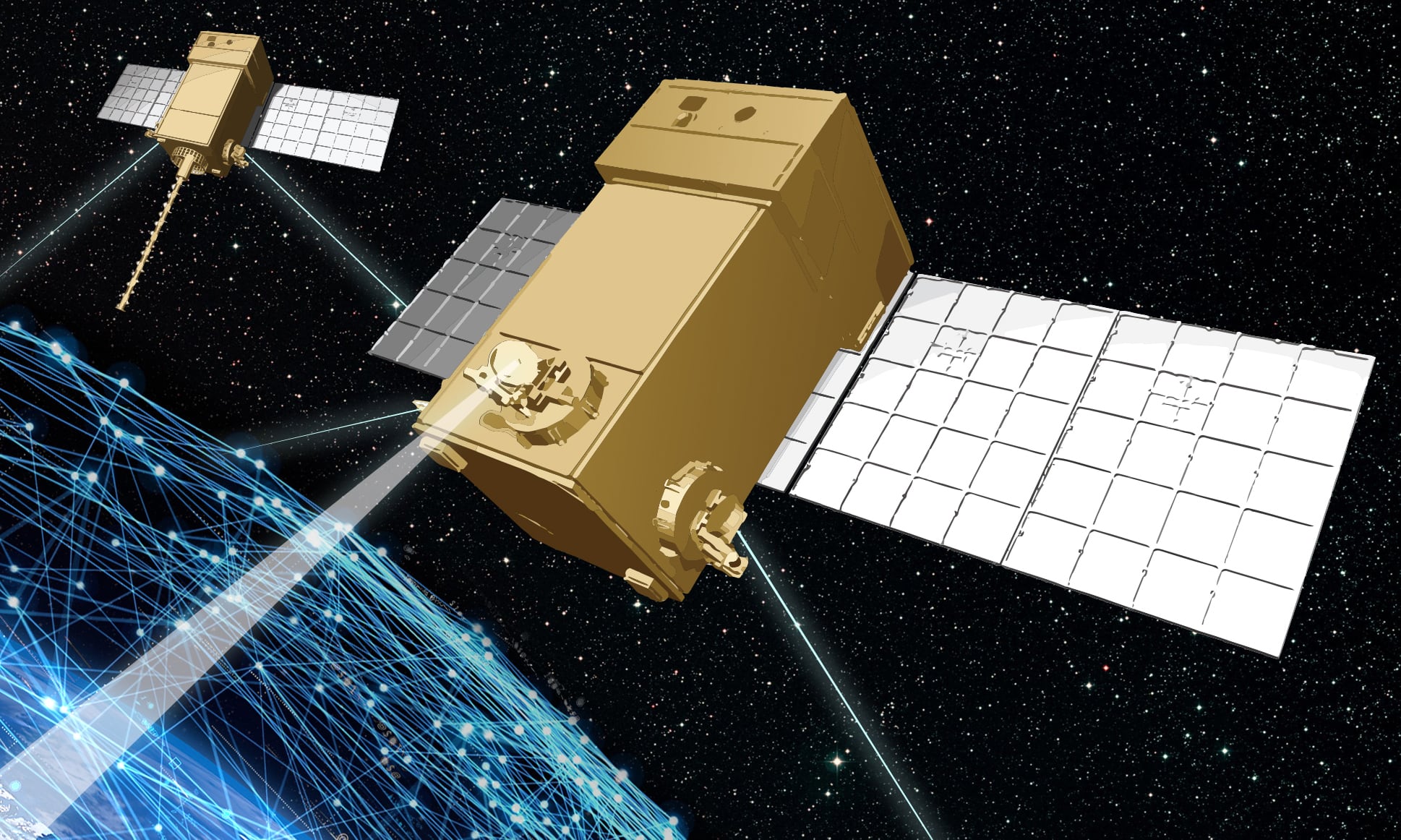

Turner was reflecting on the first two rounds, or “tranches,” of contracts SDA awarded for its space transport layer, which will create a mesh network of communication satellites that can transfer information from on-orbit sensors to users on the ground. In August 2020, the agency chose York Space Systems and Lockheed Martin to build 10 satellites each for Tranche 0 of its transport layer.

Last month, SDA announced the second round of transport layer awards, awarding $1.8 billion in contracts to three companies: Lockheed, York and Northrop Grumman.

While the decision may have appeared to favor incumbents, Turner said, the selection was based on which companies wrote the best proposals, which is the government’s prerogative.

The bigger issue the agency is now grappling with is supply chain dependencies among those three companies. While SDA chose three primes to build out its transport layer, there are multiple instances of sole-source suppliers at the component level, Turner said.

“So, we’ve got single points of failure built into our system that we exacerbated by virtue of the fact that they have three customers that they’re working for to provide us a capability,” he said. “So, how do they adjudicate across their three customers if they start having problems delivering what we need?”

Along with its transport layer contracts, SDA is partnered with L3Harris and SpaceX for Tranche 0 of its tracking layer, which will consist of eight missile tracking satellites slated to launch in 2023. The agency released a solicitation on March 17 for at least 28 Tranche 1 satellites.

A senior defense official told reporters March 15 that SDA is closely monitoring the supply chain for all of its satellites. Parts shortages, particularly for electronics, are a concern for the agency.

“Those are still items that our primes are working pretty closely with their subcontractors to make sure they can mitigate,” the official said. “They all have closure plans on how to get there, but those parts are not sitting on the shelf ready to go right now.”

Turner said that as SDA matures its business model through additional contracts — the plan is to award new batches of satellites in each capability layer every two years — it hopes to address some of these early issues.

“Starting next year, we’ll begin the process of acquiring Tranche 2 to go up beginning in ‘26. So, we’re going to be thinking through everything that we’ve done up to this point and seeing how we can solve some of the problems we’ve created,” he said.

Outside of supply chain and competition concerns, Turner said another issue SDA will likely face — particularly when it launches the Tranche 1 transport satellites — is risk tolerance. The Tranche 1 Transport Layer includes 126 satellites and, he noted, even if the mission achieves a 95% success rate, that would mean six satellites failed on orbit.

“If we spend three years in failure review boards for six on-orbit failures when the average cost per vehicle across 126 [satellites] is $10 million, we have failed as an agency completely and utterly,” he said. “We talked about the government getting out of its way, that will be the biggest hurdle that we’re going to trip over if we’re not careful.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.