The U.S. Air Force is expected to launch the next satellite in its Wideband Global SATCOM (WGS) program as early as March 13, a move that will bolster the military’s foundational communication network.

The addition comes at a time when the military is under increasing pressure to build up its communication capacity as tactical battlefield sensors and other data feeds create the need for added throughput.

“The more data we use, the more congested it gets. Having more satellites gives us greater capability to deliver more information in a hurry,” said Army’s Lt. Col. Anthony Whitfield, Product Manager, Wideband Enterprise Satellite Systems (PdM WESS).

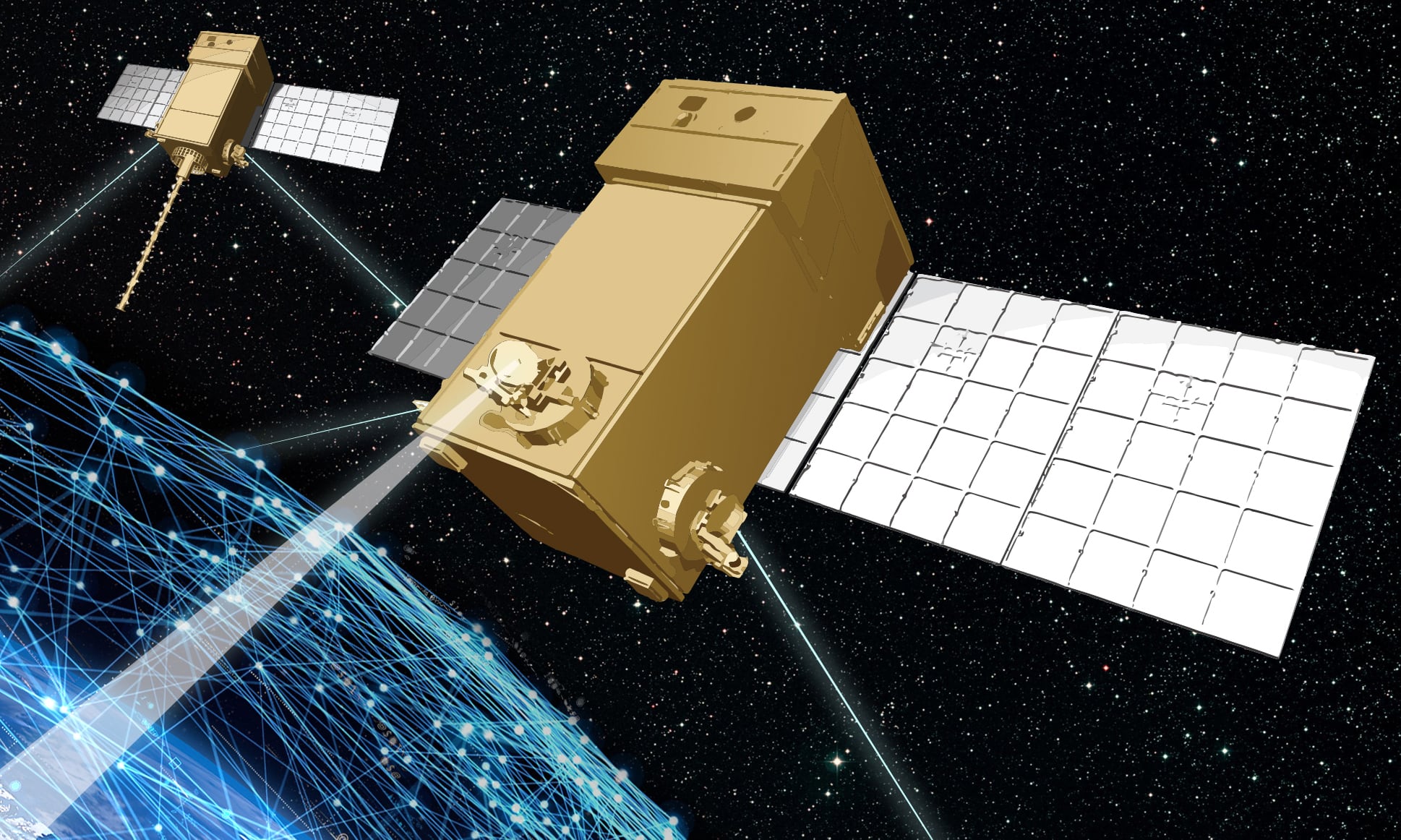

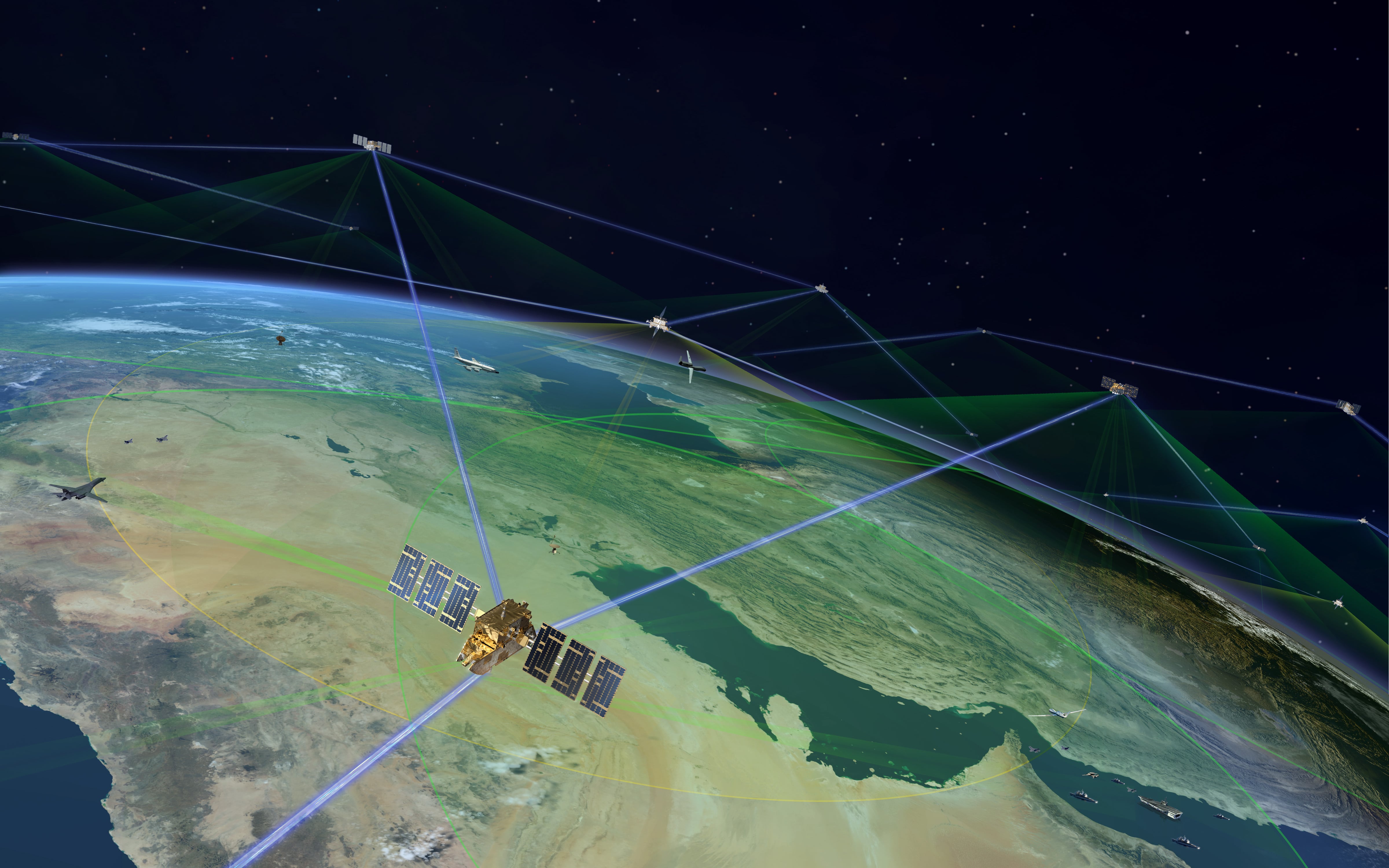

WGS is the military’s fundamental communications network and has an estimated cost of about $4 billion, according to the Government Accountability Office. The system of 10 satellites, built by Boeing, provides bandwidth and communications for tactical C2, C4ISR, battle management and combat support information.

While WGS-10 was originally slated to complete the constellation, it now seems likely more satellites may come. In the most recent omnibus spending bill, Congress appropriated funding for two additional WGS satellites, although SpaceNews reported there are questions about funding the launch of those payloads.

Should those future satellites come to fruition, Army leaders would have no complaints. In addition to fielding the ground control units that operate the constellation, “the Army is also one of the biggest users of WGS, and anything that can help us to deliver information across the globe for our senior leaders to make decisions -- we would welcome that,” Whitfield said.

In fact, the Army has taken steps lately to bolster its own operation capacity around WGS.

In 2018 the Army’s Cyber Center of Excellence unveiled a wideband training and certification system (WTCS), for students enrolled in the school’s Satellite Systems Network Coordinator Course. Soldiers training to staff the Army’s wideband satellite communications operations centers (WSOC) located at five military installations worldwide, can use the system to leverage classroom learning against simulations generated from real-world events.

“By using [that training system] to ‘train how we fight,’ WSOC operators will be better prepared to deliver their 24/7, no-fail mission to enable satellite communications for our Warfighters. It is all about operational readiness, the Army’s number one priority,” said Col. Enrique Costas, the Program Manager for Defense Communications and Army Transmission Systems, in announcing the new training tool.

The Army’s focus on supporting WGS falls in line with an overall military emphasis on the importance of satellite communications.

“We must continue to build a robust SATCOM network that includes our allies and partners and leverages commercial SATCOM industries to integrate, synchronize, and share global SATCOM resources,” Air Force Gen. John Hyten, the head of U.S. Strategic Command, told the House Armed Services Strategic Forces Subcommittee in 2018. “Our protected wideband communications are essential for allowing the warfighter to communicate in contested environments.”

New capacity

WGS-10 also will bring with it a more sophisticated payload, with more robust communications capabilities.

“It provides the bandwidth to transfer your data ― that hasn’t changed ― but we are always looking to move that data faster,” Whitfield said. “When we originally built WGS 1, 2 and 3 they were built to certain specs, they provided a certain capacity. Over time it has gotten better. We moved forward, we have continued to build additional capacity.”

For security reasons, Army leaders have not disclosed the exact nature of the latest enhancements.

In addition to supporting American forces, the enhanced networking capability will be leveraged by a coalition of allied forces that support the WGS constellation, including Canada, Denmark, Luxembourg, the Netherlands and New Zealand.

Looking ahead, SATCOM analysts have said that the congressional nod toward WGS 11 and 12 could shift the dynamic away from commercial satellite providers, who have long been angling for a bigger piece of the military space market. It remains to be seen, though, whether and how the Pentagon will decide to pursue future WGS acquisitions.

“There has been an analysis of alternatives for what’s next. That analysis has been conducted and we are awaiting further guidance. Right now, we don’t know what is next,” Whitfield said.