WASHINGTON — As the Department of Defense puts more resources into responsive space architectures, L3Harris feels well positioned to compete for and win space system contracts.

The concept of responsive space architectures differentiates itself from the exquisite satellite systems DoD has traditionally invested in.

“The current space architecture is largely based on high performance — or exquisite — systems. These systems are costly and take a decade or more to develop and put into service,” said President of Space and Airborne Systems Ed Zoiss during a March 10 investors briefing.

“But this architecture is fragile, with a few high-value targets for our adversaries to attack,” he continued. “What’s needed is a new architecture: One that can keep pace with the ever-evolving threats, one that can be put into service rapidly, and one that is a magnitude less costly. That architecture is what we call responsive space.”

Exquisite systems are generally made up of a handful of satellites in geosynchronous orbit, while responsive space approaches look to take advantage of proliferated constellations made up of dozens or even hundreds of satellites in low Earth orbit. L3Harris has played a role in the development of exquisite systems, contributing payloads for weather, GPS and other satellites for the military.

RELATED

The Space Force’s chief architect has voiced support for such a distributed, hybrid architecture, made up of the exquisite satellites and the new proliferated constellations. While the Space Force hasn’t articulated exactly how it wants to build out that distributed architecture, the Space Development Agency is already constructing its new National Defense Space Architecture. With an initial 28 satellites set to begin launching in 2022, SDA plans for the NDSA to include hundreds of small satellites within the decade.

While the pivot to more constellations with many satellites is nascent, L3Harris has made inroads in the Pentagon’s emerging responsive space portfolio.

“L3Harris has become an early leader, with six new wins in responsive space,” said Zoiss. “The key to our success has been our deep mission knowledge, our payload expertise and our ability to deliver rapid solutions.”

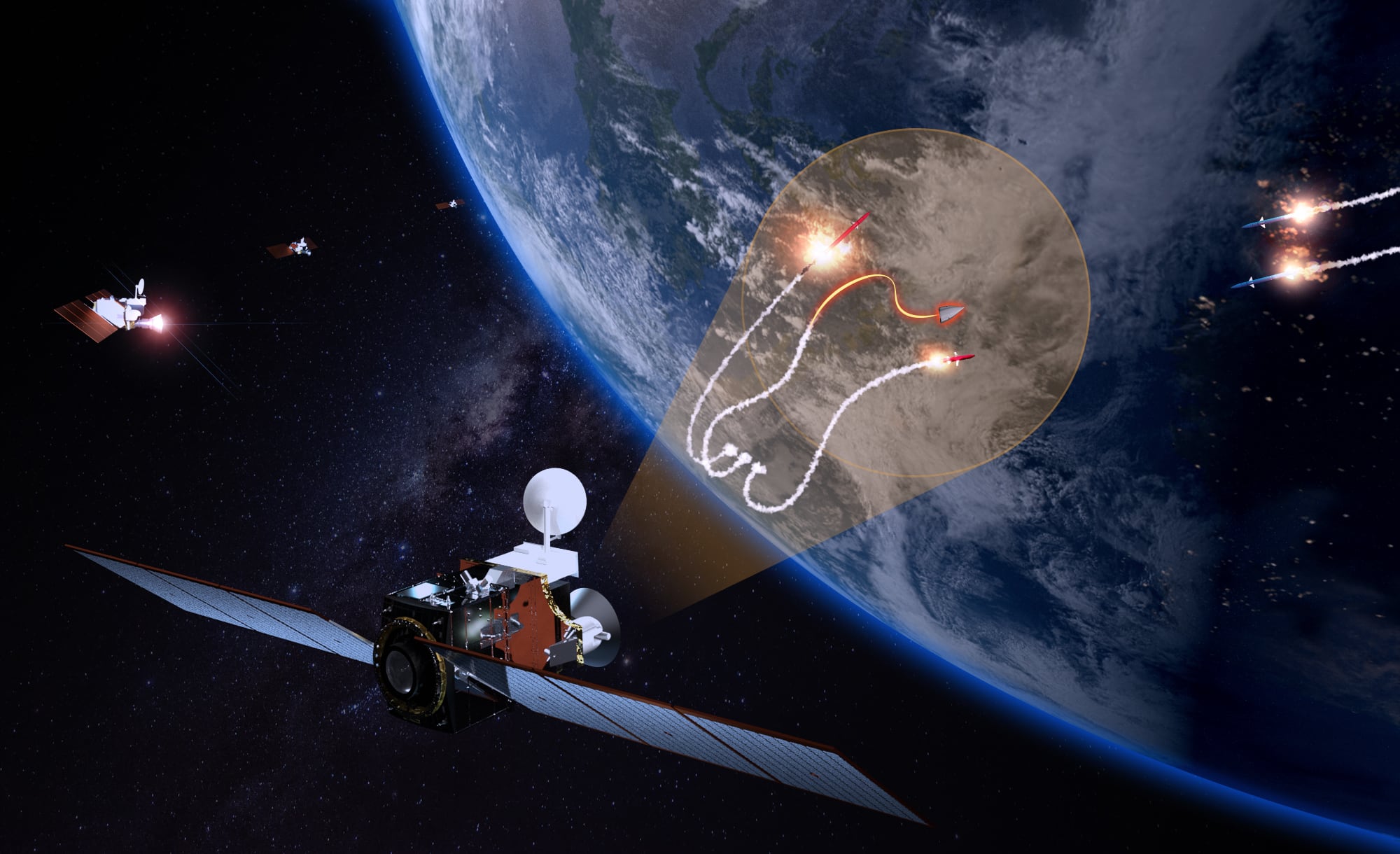

Some of those contracts are classified. Among the public deals, the company was awarded $193 million to build four of the eight SDA tracking satellites in the initial constellation. And in January, the Missile Defense Agency allotted L3Harris $121 million to build a prototype satellite for its Hypersonic and Ballistic Tracking Space Sensor, which will work in conjunction with the SDA tracking satellites to detect and follow hypersonic weapons. The company is also the prime contractor on a responsive space constellation commissioned by the U.S. Air Force, with the first demonstrator satellite launched last summer.

Part of the reason for this early success, said Zoiss, is the commercialization of the satellite bus, which houses the mission payloads on orbit. Traditionally, DoD awarded contracts to the bus manufacturer, which could then subcontract for the actual mission payloads incorporated into the bus. But treating the bus as a commodity makes awarding prime contracts to payload providers like L3Harris far more attractive to the Pentagon. Those companies can now select from a number of commercial buses to house their payloads, a shift that allowed L3Harris to move from a payload provider to a full end-to-end solution provider, said Zoiss.

This isn’t always the case. For instance, the other company building SDA tracking satellites — SpaceX — is providing the bus and subcontracting for the mission payload. Still, Zoiss feels that the trend is moving the other way.

One significant difference in the responsive space approach is the length of the contracts and the Pentagon’s desire to avoid long-term commitments to single vendors. While exquisite satellite contracts promised vendors a decade or more of guaranteed income, responsive space contracts commonly run two to five years. Moreover, winning the first batch of satellites doesn’t guarantee that contractor will win subsequent rounds, since DoD has prioritized open architectures to avoid vendor lock. For instance, SDA plans to launch new tranches of satellites every two years as replacements and additions to the NDSA. L3Harris providing four of the first eight tracking satellites does not guarantee that it will win contracts for subsequent tranches.

Plus, the value of responsive space contracts is significantly lower than exquisite systems awards. Compared with the L3Harris $193 million contract to build four missile tracking satellites, Lockheed Martin and Northrop Grumman have raked in billions of dollars to build just five missile warning satellites for the Next Generation Overhead Persistent Infrared constellation.

L3Harris still expects to contribute to exquisite systems. The responsive space approach has simply opened up new opportunities — ones where L3Harris can be the prime contractor.

“It’s not an either/or. We believe that there’s going to be a continued need for both exquisite and responsive solutions,” said CEO Bill Brown in an interview. “On the responsive side, we’ll prime. On the exquisite side, there will be some other larger prime … and we’ll provide really important components to that.”

Zoiss added: “Our move into responsive space has unlocked $9 billion of market opportunity in constellation production, and it is just the beginning.”

Despite being No. 9 on the Defense News Top 100 list of global defense companies and bringing in nearly $14 billion in defense revenue in 2019, L3Harris sees itself as the type of nontraditional contractor that the Pentagon wants to work with to build the responsive space architecture.

“We sometimes talk about ourselves internally as kind of being a new entrant. I mean, we’re 20 months old and what [Space Force Chief of Space Operations Gen. Jay Raymond] is really looking for is someone who can be flexible and agile and can get him things quickly, whether through acquisition or production. So I think we’re not too far off from what he’s looking for,” said COO Chris Kubasik.

That’s what L3Harris says is its advantage: It has the domain experience from years of contributing payloads to DoD platforms, but it operates at the commercial speed of a nontraditional vendor.

Nathan Strout covers space, unmanned and intelligence systems for C4ISRNET.