WASHINGTON — L3Harris Technologies completed a $1.96 billion purchase of Viasat’s tactical data link business, an acquisition expected to better position the 10th largest defense contractor to win orders tied to the Pentagon’s Joint All-Domain Command and Control initiative.

The companies announced the closing Jan. 3, some three months after the arrangement was first disclosed. L3Harris on Dec. 20 said regulators gave it the green light, accelerating a purchase that was initially thought to wrap later this year.

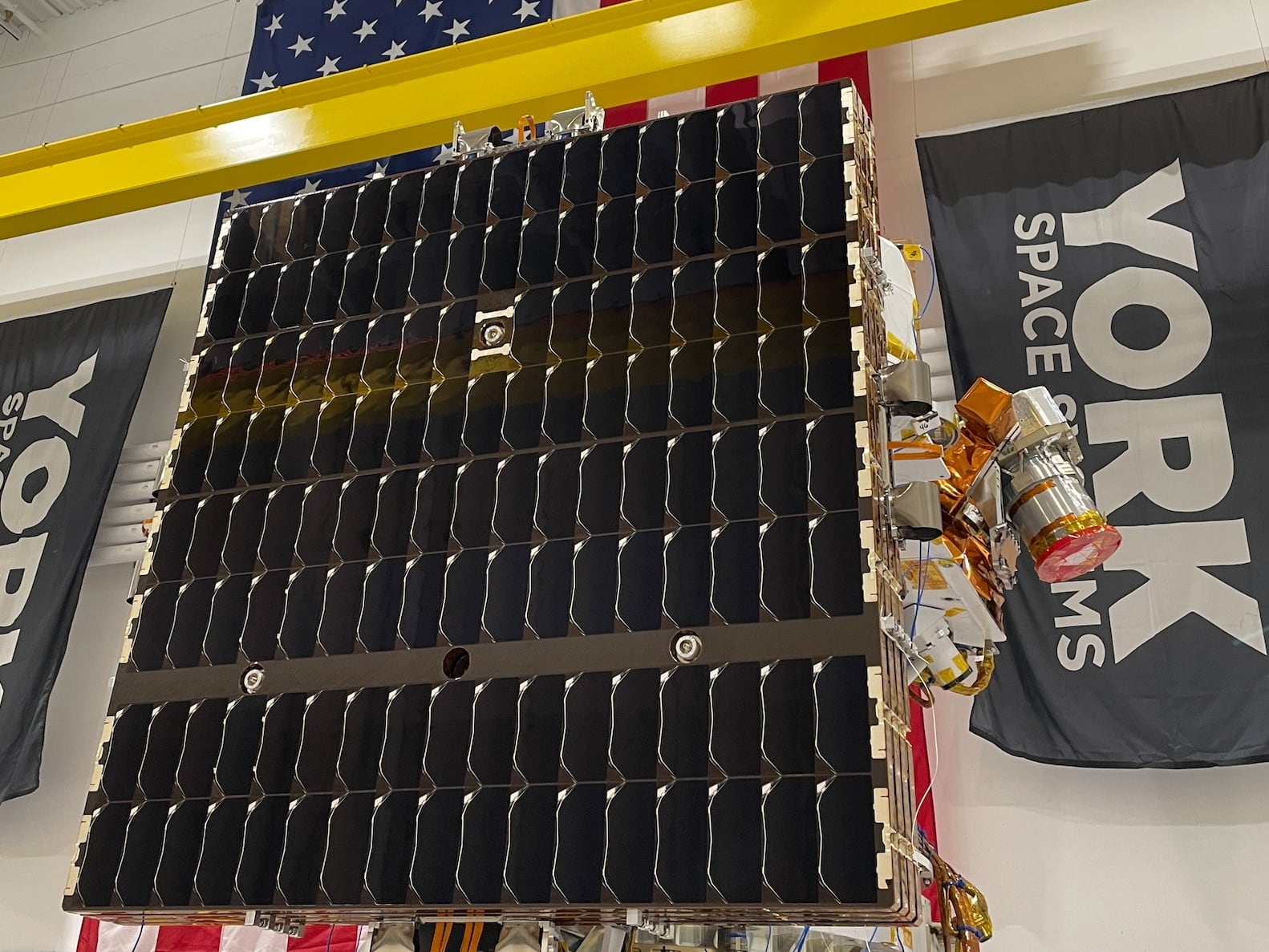

The buy consists of Link 16 Multifunctional Information Distribution System platforms, their associated terminals, which are installed in tens of thousands of U.S. and allied systems worldwide, and space assets. After taxes and other fees, Viasat will net some $1.8 billion for a business that generated $400 million in sales annually. The money is slated to be used to pay down debt and buttress efforts already underway.

RELATED

Brendan O’Connell, the president of the broadband communications division at L3Harris, told C4ISRNET the Link 16 assets are “a very natural fit” for the company, which he billed as a “leading defense and electronics provider, really for a global customer base.”

Link 16 is a secure, jam-resistant and high-speed line of communication used across domains and by international players, including NATO.

“We’re looking, as a trusted disrupter, to really enable our Department of Defense customers and international partner customers to modernize and really build a whole connected, interoperable force, to allow them to operate in contested environments,” O’Connell said Dec. 28.

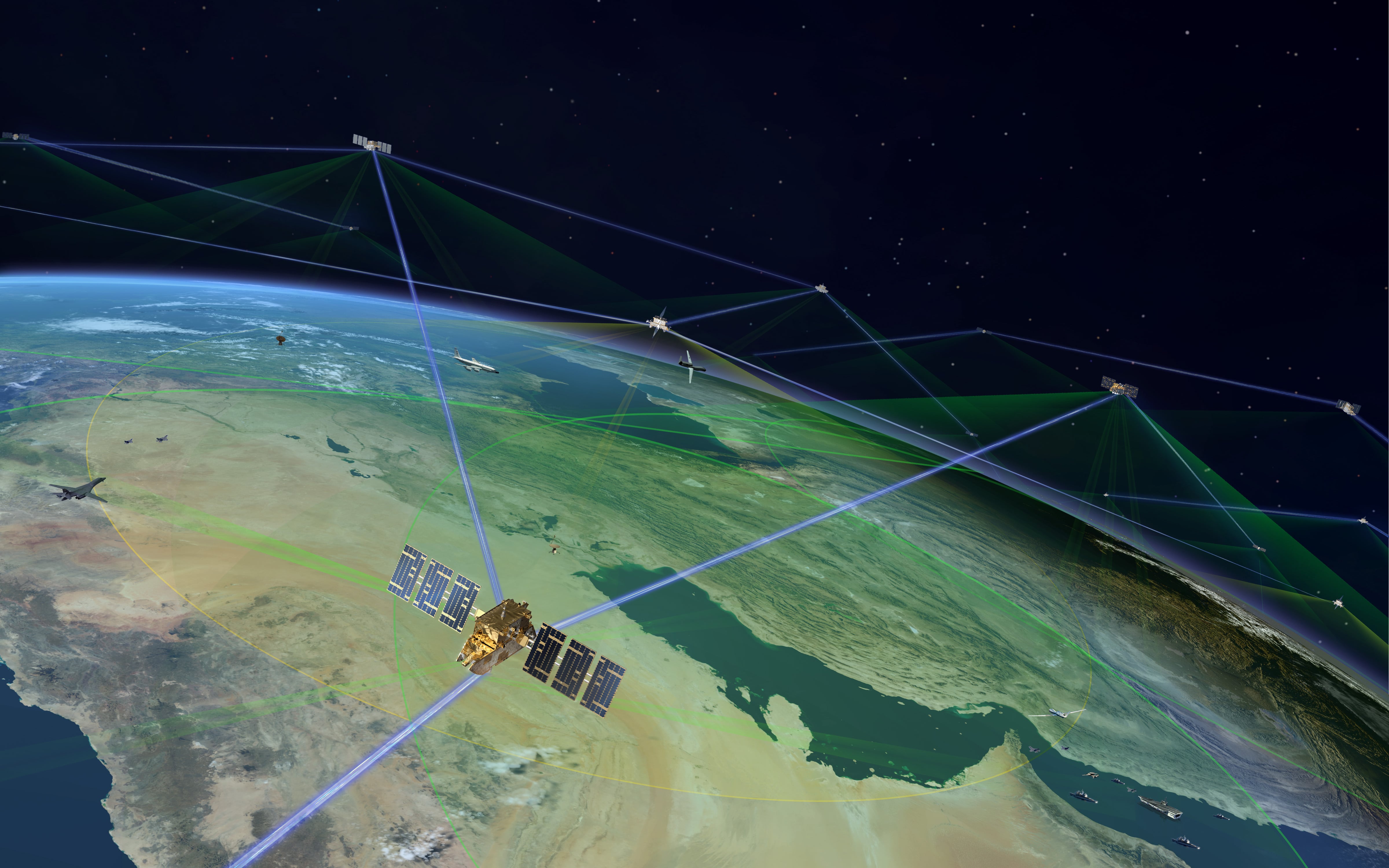

Ensuring forces across land, air, sea, space and cyber get the information they need when they need it is among the Defense Department’s top priorities as it prepares for potential conflict with China and Russia, two world powers capable of intercepting, jumbling and terminating communications. The department’s push to seamlessly link disparate databases and make compatible old tech with new is known as Joint All-Domain Command and Control, or JADC2.

The endeavor includes specific contributions from the Army, Air Force and Navy: Project Convergence, the Advanced Battle Management System and Project Overmatch, respectively.

L3Harris in mid-September was named to the ABMS Digital Infrastructure Consortium alongside four other companies: Leidos, Northrop Grumman, Raytheon Technologies and Science Applications International Corporation. The collective is meant to accelerate development of ABMS, a next-generation of command and control.

The Link 16 portfolio will only increase the competitiveness of L3Harris, O’Connell said, and will extend its reach to nab contracts. JADC2-related opportunities are lucrative; L3Harris, Viasat and others were in 2020 selected by the Air Force for a $950 million indefinite delivery, indefinite quantity arrangement.

“We’re really in a great position as a key JADC2 provider, especially when you add to that fact that we’ve done a lot of investments here in the last 10 years to develop resilient networking capabilities,” O’Connell said. “I think we inject a whole new set of ideas and capabilities to the current Link 16 portfolio we are acquiring.”

What’s next for Viasat?

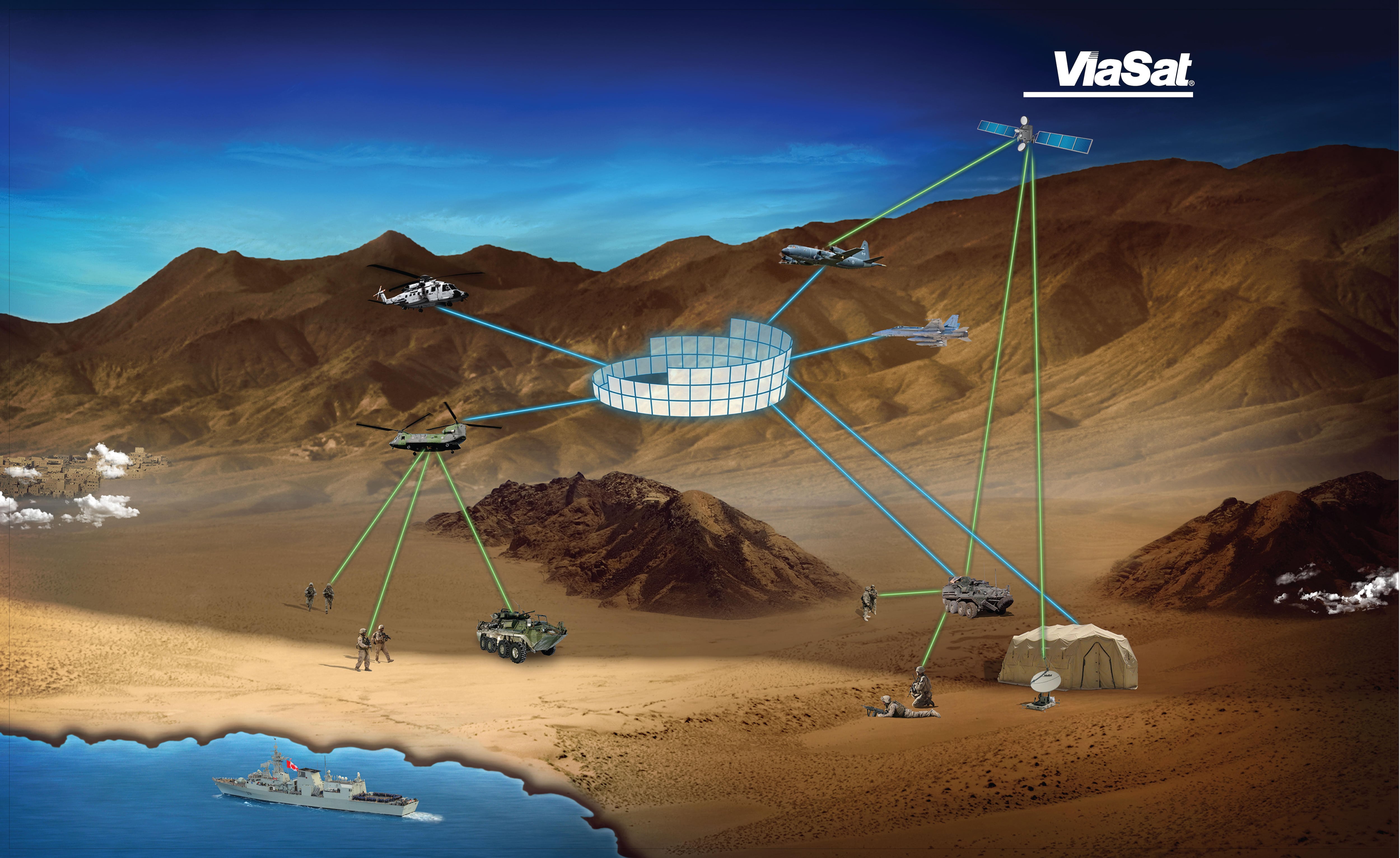

Viasat plans to use the proceeds from the sale to accelerate and fortify ongoing projects. Link 16 accounted for one-third of its government business.

“The $2 billion purchase price gives us a lot of flexibility to do things we’d like to do. It gives us a better cash flow. We can manage our debt more effectively. And, most importantly, it gives us a really strong reservoir to invest,” Craig Miller, the president of Viasat’s government systems branch, told C4ISRNET on Dec. 5. “There’s a lot of things we want to do in terms of really bringing our broadband network to global capability as quickly as possible.”

RELATED

Viasat, the No. 73 largest defense contractor in the world ranked by revenue, according to Defense News analysis, has no plans to exit the defense ecosystem. Rather, the satellite giant is consolidating and refocusing and paying particular attention to its multibillion-dollar takeover of Inmarsat, a British outfit that furnishes communications and data services worldwide.

Viasat officials believe the Link 16 portfolio — described in October as a JADC2 “accelerant” — will serve L3Harris well. The two have a long-standing relationship; Viasat CEO and Chairman Mark Dankberg in an October blog post described L3Harris as “our long-time data link partner.”

“We’re a very complementary company. There are places where we compete, but they’re kind of few and far between,” said Miller, who has worked at Viasat for nearly three decades. “This is a very good business. But we’re optimistic that they can probably even do more with it.”

Colin Demarest was a reporter at C4ISRNET, where he covered military networks, cyber and IT. Colin had previously covered the Department of Energy and its National Nuclear Security Administration — namely Cold War cleanup and nuclear weapons development — for a daily newspaper in South Carolina. Colin is also an award-winning photographer.