WASHINGTON — Google may be backing away from future Pentagon contracts, but defense companies are finding a receptive audience in Silicon Valley startups, the head of Lockheed Martin’s venture fund said Wednesday.

Chris Moran had spent about 30 years of his career in Silicon Valley before taking over Lockheed’s venture fund in June 2016. So naturally he felt “a little trepidation” about moving into the defense sector, he told a group of reporters at June 6 roundtable.

“Almost from the outset, I was pleasantly surprised by the embracement from the folks that I met both inside the company and in the startup space, finding those technologies, talking about the problems that we have to work on, and finding that they were very excited about working on those technologies and working with Lockheed Martin,” he said.

Google announced on June 1 that it plans to no longer bid for future contracts on the Pentagon’s Project Maven, which used the company’s machine learning technologies to analyze drone imagery.

When Google’s involvement in the program was disclosed earlier this year, it was met with internal criticism, including a petition signed by 4,000 employees imploring Google to vow never to work with the Defense Department, Wired magazine reported in May.

But despite the controversy, Moran said he hasn’t seen startup companies try to move away from working with defense companies — or accepting their seed money.

“I know there’s kind of an independent streak in the Valley, so maybe they want to keep some distance there,” he said. “But I haven’t seen it. When I go talk to companies — and again I’m working at the engineering level a lot of times — they are absolutely enthralled by the types of things that we work on and love the challenge.”

Major defense primes including Lockheed, Boeing and Airbus have recently started venture funds with the hope of deepening ties with fledgling commercial tech businesses, and Moran said the companies’ engagements in Silicon Valley have made defense firms more credible as a partner.

Now, Lockheed is doubling down on its investments. Moran announced during the roundtable that Lockheed will take $100 million of the money saved from recent tax reform legislation and funnel it into the its venture capital fund — increasing that pool of money two times over.

Since 2016, the company has invested $40 million in eight companies, some of which have not be publicly disclosed. While Lockheed’s venture capital arm gets about 500 leads on new technology a year, Moran wants to be able to double that.

“We’d love to go from — generically — about four investments per year, we’d love to get to six or even eight,” he said. “The $200 million will help us to work with more companies, and our goal is to try to get those relationships teed up earlier than later.”

RELATED

With its new infusion of funds, it might also look to emerging technologies like quantum computing and quantum sensors, where there has been a lot of recent activity.

“Many companies have been formed in the last two years in that, so we’re looking in those areas as well,” Moran said.

So what has Lockheed been getting out of its venture capital investments?

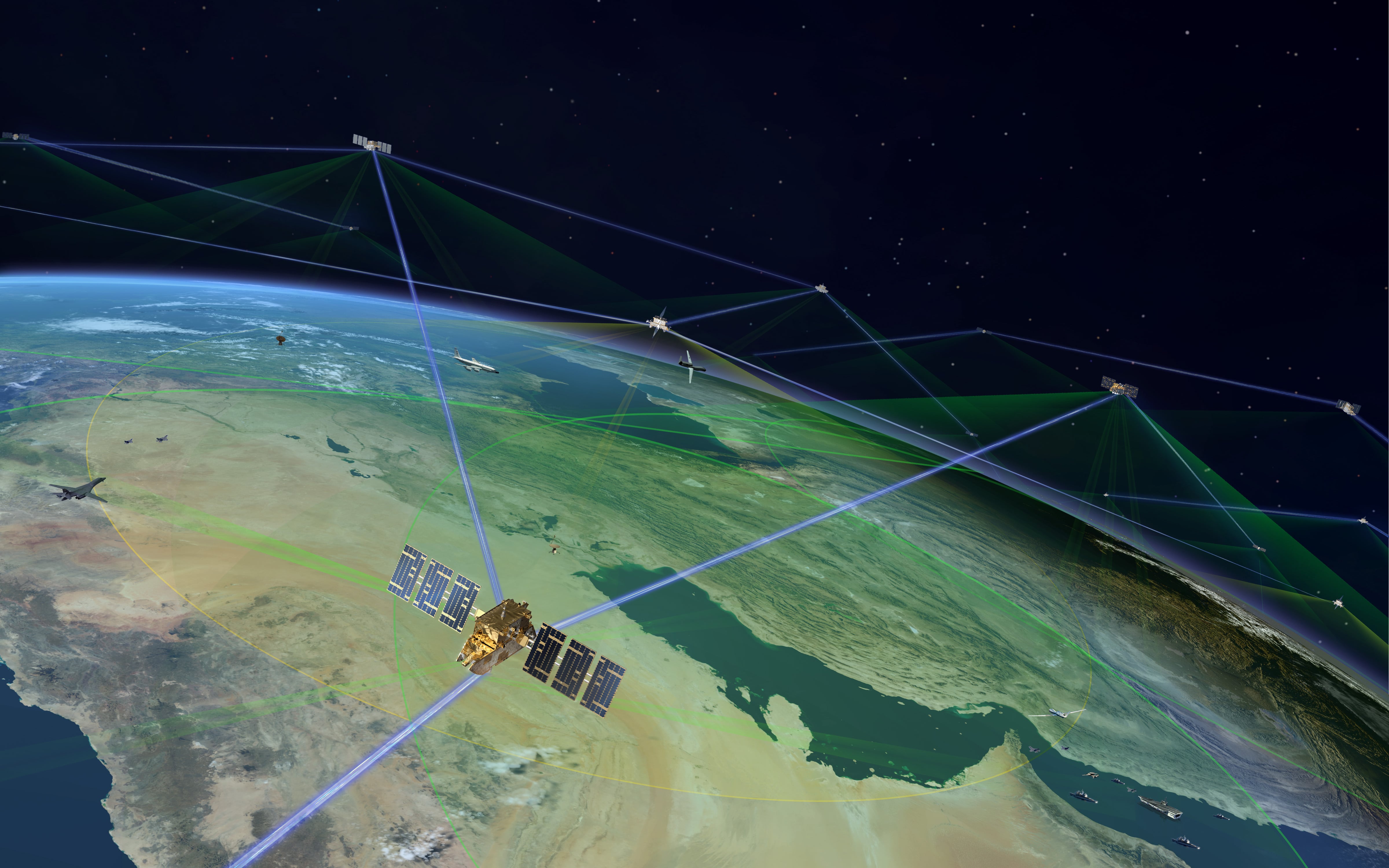

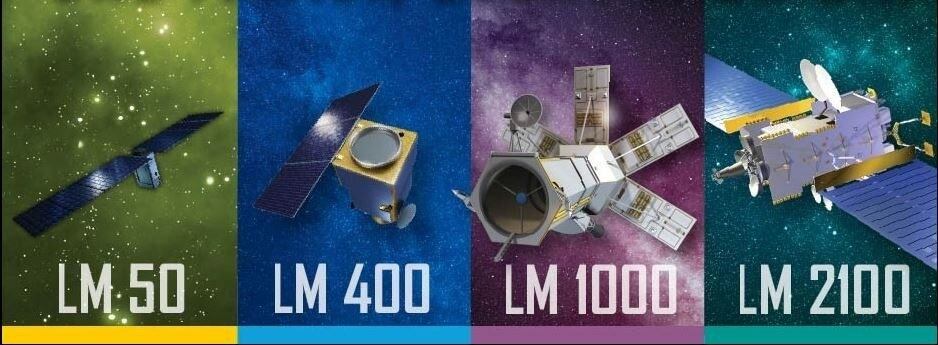

Unlike other investors, Lockheed isn’t funding companies in the hopes of getting a massive financial return. Instead, it wants to invest in startups with big commercial potential, which are developing technologies that could give Lockheed a strategic edge in areas like cyber, space, artificial intelligence, autonomy, 3-D printing and data analytics.

“The perfect investments for us are those that are scaling and growing through commercial activity but at the same time are maturing, hardening, becoming more reliable as a result of the volume and scale that the commercial space can bring,” Moran said.

For instance, Lockheed has made investments in commercial radar and lidar companies closely aligned with the automobile industry.

If those products end up being successful and are integrated into hundreds of thousands of cars, that drastically decreases down the price for customers like Lockheed who could use the system for defense applications and creates a bigger pool of money for the startup to reinvest in its own infrastructure.

While a lot of venture funds are used by companies to pave the way for a future acquisition, that isn’t the case for Lockheed, which would rather keep those firms as potential suppliers based in the commercial sector.

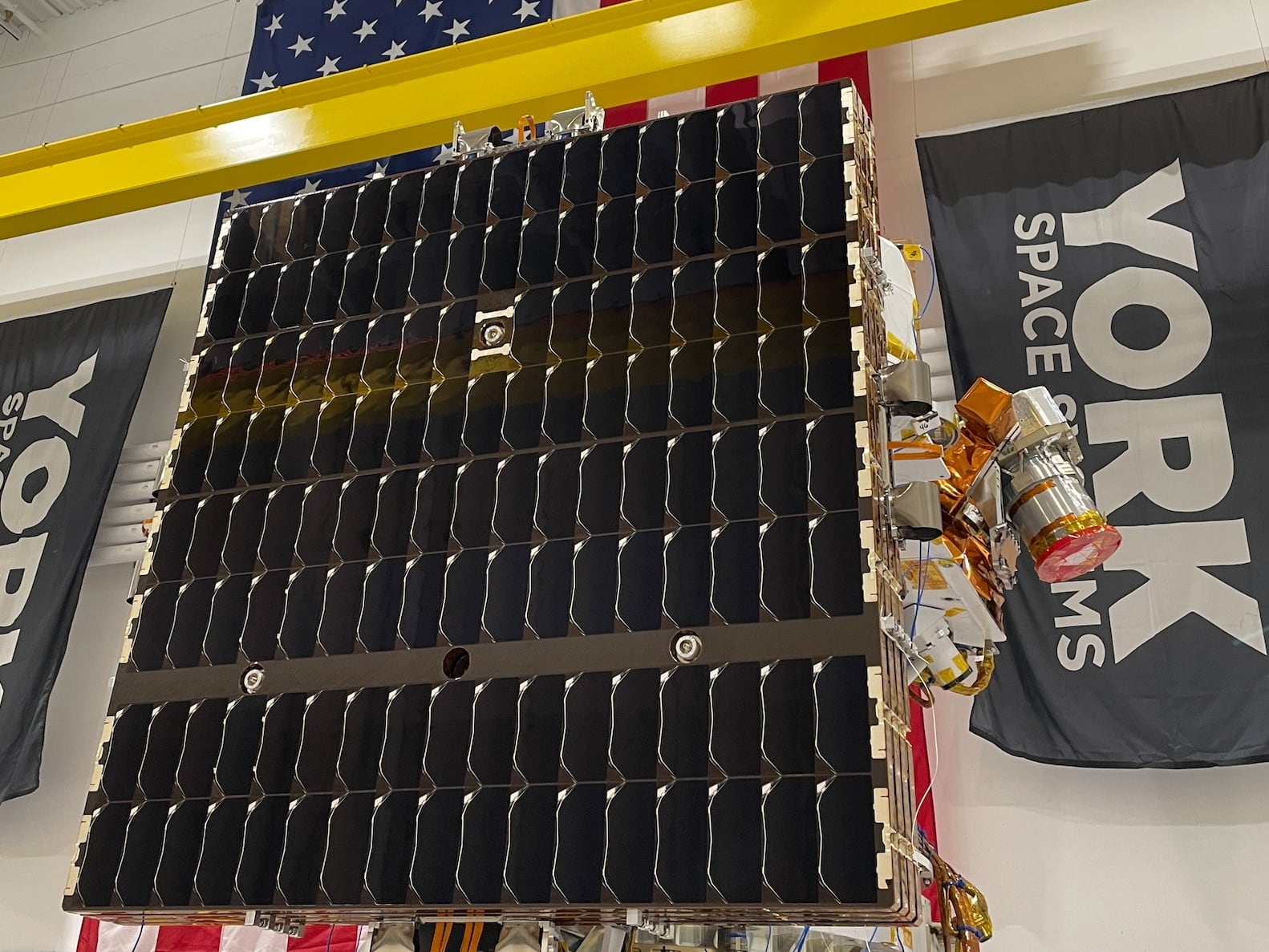

“A home run would look like an entire portfolio of companies we’re working with like Terran Orbital,” the nanosatellite company that Lockheed has partnered with on Defense Department and NASA contracts, said Moran.

Through Terran Orbital, “we found a really capable technology that had immediate or near term application to things that we’re running with our government customers,” he said. “We could both grow them, grow our ability to enter new markets or hone our abilities in existing markets.”

Valerie Insinna is Defense News' air warfare reporter. She previously worked the Navy/congressional beats for Defense Daily, which followed almost three years as a staff writer for National Defense Magazine. Prior to that, she worked as an editorial assistant for the Tokyo Shimbun’s Washington bureau.