JERUSALEM — In January, Elta Systems, a subsidiary of Israel Aerospace Industries, signed a contract to supply Finland with its ELM-2311 Compact Multi-Mission Radars. Elta has sold more than 100 of its MMR systems globally, and the firm hopes to increase its exposure in this market.

Eyal Shapira, director of air surveillance and counter-rocket, -artillery and -mortar systems at Elta, says the MMR radar family can provide a need for militaries preparing to face future threats. In a Jan. 21 interview with Defense News, he sketched out the company’s challenges and its hopes for the future.

Can you describe the current role of MMR and the threats it meets?

In Elta, in the near future, we see MMR and other multimission radars as the main radars that can be utilized advantageously to deal with multiple threats because this radar’s advantage is that it can take care of a very wide area of threats and different types of munitions, and can detect and track many types of aircraft and UAV and [rocket, artillery and mortar] munition. This is the future because the operational world is becoming more and more complex. And in this new situation, our flexibility and radar techniques give us a lot of advantage [facing] new threats that come to the operational world.

This is due to your experience in Israel facing the changing environment of various enemies.

In Israel, there are a lot of MMR radars, and this radar in the last five to 10 years has seen thousands of rockets and missiles and a lot of threats all over the borders of Israel, Gaza, Lebanon and Syria. This makes our product combat-proven and gives us a lot of advantage in live-firing tests because we come with heritage and experience in this wide spectrum of threats.

Can you describe the different types of radars in this group?

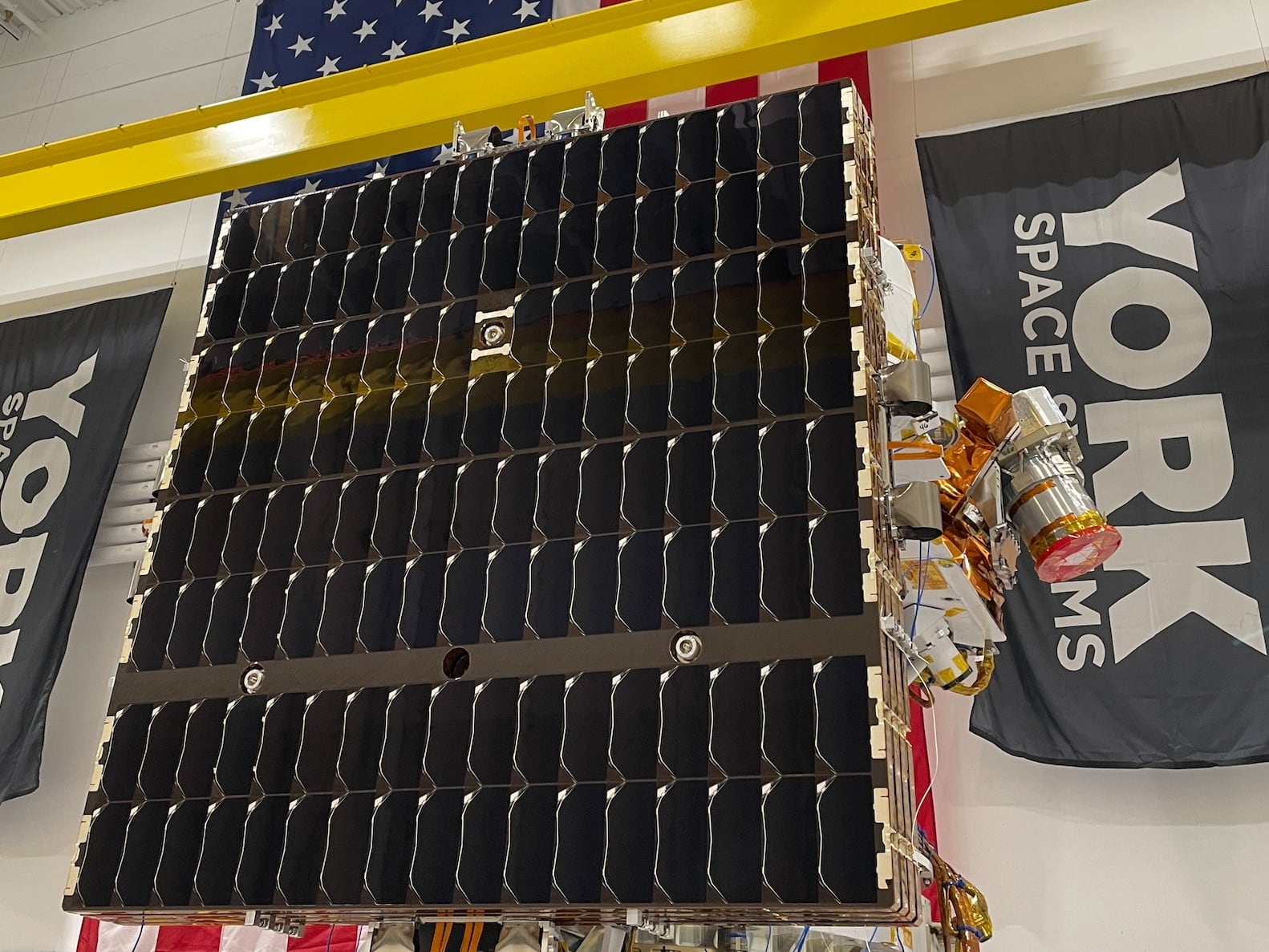

The MMR radar is a family. The Compact MMR is the compact one we sold in Finland, and we have the MMR for Iron Dome and David’s Sling for Israeli projects, and we have D-MMR, the digital future of the radar. These radars — we are selling, now, more than 110 [systems]. We sold 10 in the last year, and we think this is the main product line that gives Elta a lot of honor to be the owner of this product line of C-MMR, half digital, and the new general digital radar D-MMR.

RELATED

The main issue of the digital is that the world is going digital, and the next few years the radars in high-end technology will be digital. In the next 10 years, all the radars will be full digital.

There are many competitors in this market, including companies in Europe and the U.S. How will Elta stand out?

There are a lot of competitors in this field. This gives a solution to air defense and artillery [defense]. For instance, you have Lockheed Martin and Raytheon, in surveillance radars and in air defense, [you have] Raytheon, Lockheed and BAE Systems. There are a lot of manufacturers and contractors, and in air defense the U.S. market is the most competitive.

The main advantage and target of the new generation of radars we produce is to be a viable competitor and at a good price. For instance, when it comes to the Chinese and others, [when they] get into the field the price goes down all the time. We are still cheap compared to Raytheon and Lockheed; there are other competitors, and the electronic chips are becoming cheaper. We are trying to get to this field with the new-generation [radars] with same capability, but cheaper.

What kind of threats are we seeing on the modern battlefield that these radars will face?

The modern battlefield threats in the last decade have become more versatile. We have low [radar cross-section] RCS targets, and on the other side we have rockets which are longer range and faster than before. So the radar parameters must be able to handle a more versatile range, such as speed and RCS. We deal with high-speed rockets, and on the other side we deal with Quad UAV, small UAVs that fly at low speeds. The radar must be able to be versatile regarding these types of targets. We have the advantage in MMR — that the radar is used to working in air defense or [detecting] rockets. And this MMR can handle multimission roles in parallel — fire control, artillery and air defense.

Are there concerns of eventual market saturation with so many companies competing in the radar market?

We have a long time before that. In Israel we are all the time getting more upgrades in software and algorithms. You talked about threats, so in new threats from Syria, we work with [the Israeli] Air Force and look at new threats to the system and its ability, and type of target that the radar can handle. We are [in this field from] the start; we are close to the next 100 sales.

Our goal in the next few years [is that] we are starting in Finland, and in the next few months will close a contract with the Czechs. Europe and the U.S. are our main markets for these high-end radars. The U.S. Army [will be purchasing a few batteries of the] Iron Dome system.

Seth J. Frantzman is the Israel correspondent for Defense News. He has covered conflict in the Mideast since 2010 for different publications. He has experience covering the international coalition against the Islamic State group in Iraq and Syria, and he is a co-founder and executive director of the Middle East Center for Reporting and Analysis.