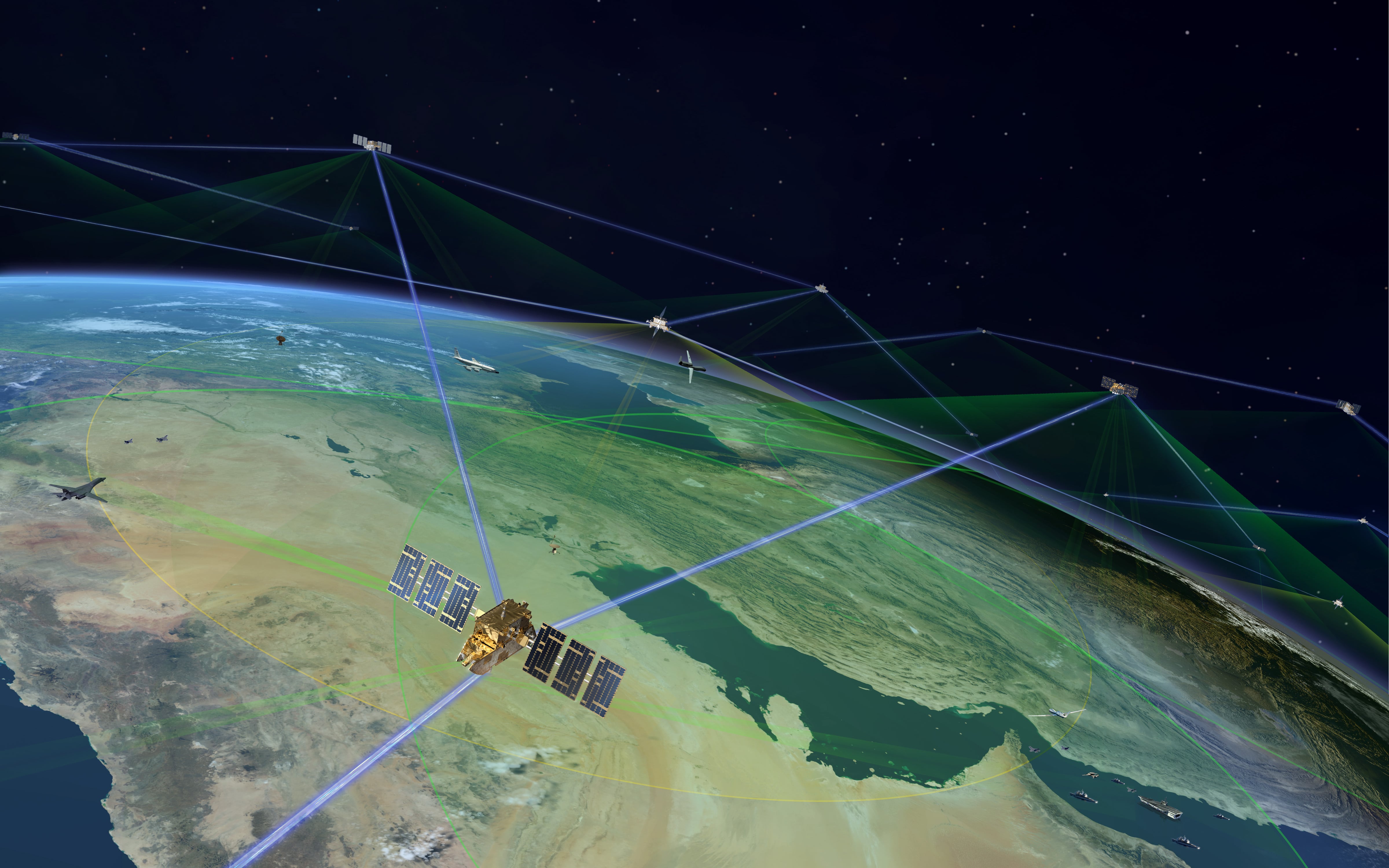

A major component of the $42 billion military satellite communications program may see an overhaul as the military reviews its options for how operational aspects of the Wideband Global SATCOM program are handled.

The WGS program, which provides bandwidth for command and control, ISR and battle management needs, is still in the prime of its life. The seventh of 10 planned satellites recently went into orbit: a $566 million spacecraft taken aloft by a United Launch Alliance Delta 4 rocket in July. But planners already have begun the effort to envision how the military might commercialize some of the satellites' operations by the mid-2020s.

The review aims in part of explore whether satellite operators could provide support services more cost-effectively, freeing military resources for other imperatives.

"What is the proper mix of WGS and commercial satcom? We really haven't looked at that in terms of considering a combined architecture," said Robert Tarleton, director of the Air Force Space and Missile Systems Center's Military Satellite Communications Systems Directorate.

In September Space and Missile Systems Center sent out a request for information to explore potential start-up and operations cost, transition timelines, and industry's ability to provide the necessary capabilities for a WGS program that would lean more heavily on commercial capabilities.

The military spends about $1 billion a year on WGS leases, while carrying much of the burden for upgrades and upkeep. "This is where our commercial satcom comes into play. The technology there and the upgrades to technology are so much faster than what we have been able to do in DoD," Tarleton said.

A program review, slated to conclude by spring 2017, could recommend a number of scenarios for shifting operation, control and maintenance tasks from Air Force Satellite Control Network to private industry. Government still would manage key command and control elements.

As the military considers future arrangements for the management of WGS satellites, a parallel effort is under way to take a fresh look at satellite acquisitions.

The project known as Pathfinder 1 last year awarded an $8.5 million contract to satellite services provider SES. Under the contract the military broke with the traditional practice of leasing satellite capacity, opting instead to purchase part-interest in a satellite, with an eye toward gaining greater visibility over Africa.

"We own a piece of this, we've got it for five years with a specific mission," Tarleton said. That mission has since evolved, but the basic premise of Pathfinder remains intact. Planners are building toward Pathfinder 2 — a $23 million contract slated to be awarded by the end of 2016 — and three more purchases.

Satellite access that is purchased could cost just 20 percent of the present price of leasing, Tarleton said. As part owner on a new satellite, rather than as a renter on an older spacecraft, "we can influence the design to some degree," he said.

Industry leaders say they hope that the opportunity to influence will be reciprocal.

In the past, commercial suppliers have augmented milsatcom, but never been fully integrated into the design of military-use satellites. As contracting models come under review, "at the top of the list we are saying: Include us in the design of the architecture," said Skot Butler, vice president of satellite networks and space services at Intelsat General.

If industry could be included earlier in the design process, it would be possible to build more military-specific features into any new satellite.

"It's about engaging with the government, understanding not just what the threats are but what the responses need to be. It is a very dynamic environment," said Rebecca Cowen-Hirsch, senior vice president of government strategy and policy for Inmarsat.

If industry is to be included in the development of satellite architecture, the process should start sooner rather than later. "If you count back from the mid-2020s to today, it will typically take at least three years to build a satellite, and they are going to want new technologies and new features included in that," Butler said.

As planners consider big-picture plans for the future of satellite programs, others are making advances at the tactical level.

The Marine Corps, for instance, has introduced a Hatch-Mounted Satellite Communication Antenna System for use in the C-130 Hercules aircraft. The HMSAS delivers secure voice, tactical network access, secure chat and streaming video for commanders in the field. The program is managed by the Marine Air-Ground Task Force (MAGTF) Command Control and Communications team at Marine Corps Systems Command.

With five initial systems fielded in May 2015, HMSAS offers a big improvement on previous systems that supplied only voice connectivity, said Basil Moncrief, product manager, technology transition, MAGTF Command and Control.

"It's got a satcom system that allows the aircraft to stay fully connected with all of the networks and databases anywhere in the world while transiting continent to continent," Moncrief said.

The system's basic design was crafted for executive jets and adapted that to allow secure access to tactical networks. By relying heavily on existing industry advances, planners were able to bring the system to life relatively quickly. Just 120 days passed from the time funding came through to fielding of the first systems. "It's always good to allow industry to absorb the development costs when you can," Moncrief said.

The new system could generate a substantial tactical advantage. "In the past they relied strictly on line-of-site radios, with virtually no command and control capabilities inside the aircraft," Moncrief said. "Instead of talking about it on the radio and looking at a paper map, you are looking at a digital map with the actual battlefield geometries, the actual present situation."

Other recent advances on the satellite front include a milestone moment for the $11.7 billion Advanced Extremely High Frequency (AEHF) satellite network. First launched in August 2010, it reached operational geosynchronous earth orbit October 2011. Following the launch of subsequent spacecraft, the Air Force Space Command in July declared initial operational capability (IOC) for the network.

AEHF ensures strategic communications, including nuclear command and control, for the president and strategic decision-makers. It also enhances protected communications among the tactical community.

Industry leaders call the achievement of IOC a big win for the military. "It is real progress, to see it come along and gain that initial operational capability. I think the government can celebrate that success," said Cowen-Hirsch.