EL SEGUNDO, Calif. — “Elastic” is the word Boeing’s President of Commercial Satellites Ryan Reid uses to describe the relationship between the company’s commercial, government and small satellite divisions.

Here’s what he means by that. When his team used digital technologies to significantly shrink the size of its traditional satellite communications payload, they no longer needed as much room to build it. So, they shifted to a smaller space. That made room for Millennium Space Systems, a Boeing-owned small-satellite company that is expanding its manufacturing capacity, to move in.

Along with helping accommodate Millennium’s growth, the resized payload can now fit on smaller satellites, offering a more flexible, powerful communications capability they may not have had access to before.

Vice President and Deputy General Manager of Boeing’s Space and Launch Division Michelle Parker told reporters during a recent visit to the company’s El Segundo, Calif., satellite factory, that Boeing’s purchase of Millennium in 2018 has added depth to its space portfolio at a time when customers are wanting new technology, resilient architectures and rapid production timelines.

“We’ve been able to take the Boeing knowledge of production, mission space understanding, advanced manufacturing, and help Millennium with that,” she said. “And Millennium has brought to our family that diversity of products and satellite sizes. . . . The way they do design and development and rapid prototyping is really something we’re looking to infuse not just in our Millennium products, but through all of our space products.”

This kind of flexibility is something many space companies are embracing as they adjust to growing government and commercial demand for hybrid satellite constellations that feature more small space vehicles operating in a more diverse range of orbits.

Growing demand

Reid said that while the shift from large satellites in geostationary orbit to low Earth orbit constellations had led many analysts to predict a future where GEO systems were less relevant, that hasn’t proved out. Instead, diversity appears to be the trend in both commercial and government markets.

“What we’ve seen is, I think, a realization and a recognition that the future is not a GEO thing, it’s not a [non-GEO] thing, but it’s really this kind of hybrid, multi-orbit solution that really depends on what kinds of mission and customer base our operators and customers fundamentally are trying to address,” Reid said.

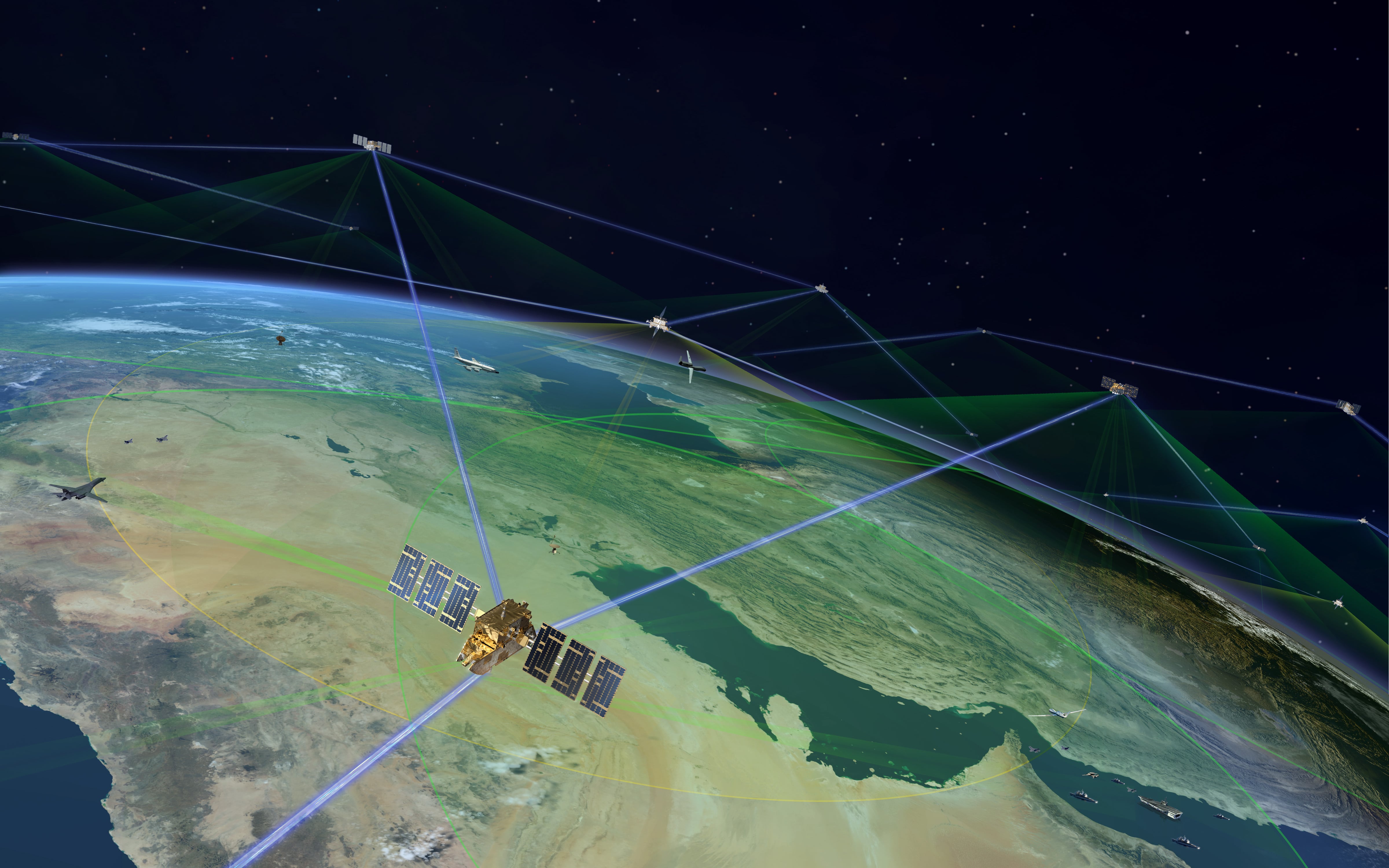

On the government side, the push for hybrid architectures is largely a push for resiliency, driven by the idea that more satellites in more orbits makes it harder for adversaries to take out large swaths of capability at once.

Speaking April 5 at the Space Symposium in Colorado Springs, Colo., Chief of Space Operations Gen. John Raymond said the service is “embarking on a transformation to more resilient architectures with diverse mixes of capabilities across multiple orbits.”

“If we are going to migrate away from our large, monolithic systems to hybrid, diversified space architectures, we cannot continue to build expensive satellites with exquisite mission assurance,” he said. “We need to focus on the reduction of cost as the key driver to build incredibly distributed architectures that are resilient in a fight. The government cannot afford a distributed, resilient force design unless industry changes with us.”

The Space Force last year created a new Space Warfighting Analysis Center tasked with analyzing, and in some cases redesigning, the service’s constellations to help achieve that end.

The SWAC completed its first force design effort last fall for the space-based missile warning and tracking mission, calling for a layered approach that augments the Space Force’s GEO-based Next-Generation Overhead Persistent Infrared System with the Space Development Agency’s vision for a missile tracking layer composed of hundreds of small wide-field-of-view satellites based in LEO. The service’s fiscal 2023 budget included a $1 billion increase for Next-Gen OPIR’s space and ground segments and another $1 billion for the SDA tracking work and a future MEO-based layer.

The SWAC is conducting similar analysis of other mission areas, including satellite communications and positioning, navigation and timing, that could drive more small satellites into those architectures as well.

Expanding production

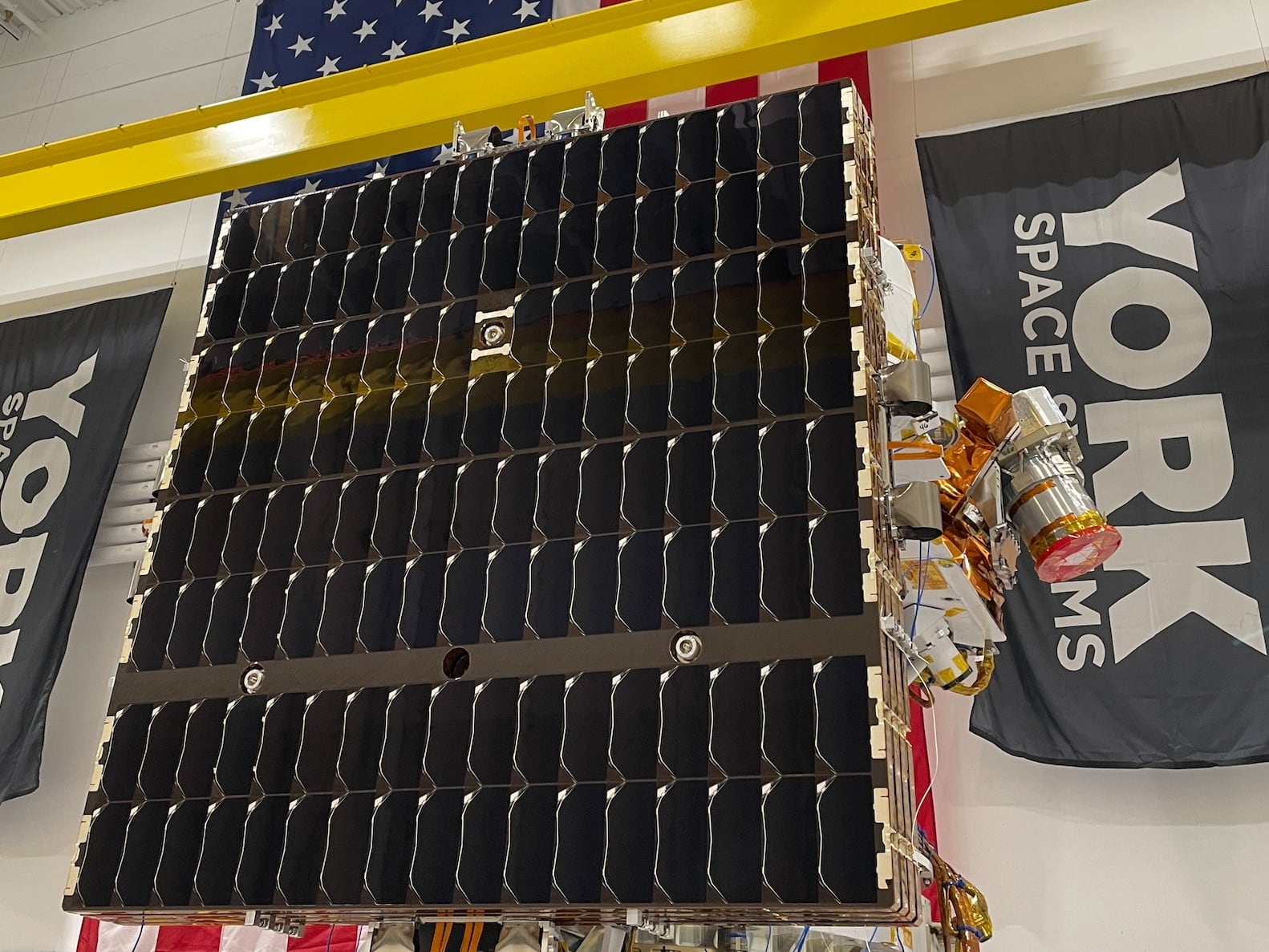

Millennium currently builds small satellite prototypes at its headquarters, about a mile away from Boeing’s satellite factory in El Segundo, Calif. The space is busy — and busting at the seams. Or, as CEO Jason Kim told reporters during a recent tour of the building, “It’s jam-packed.”

By the end of this year, the company’s new small satellite factory at Boeing’s larger facility will be fully operational, with all the tooling and processes in place to support Millennium’s current customers. The company will continue to develop prototypes at its current location, but the move into Boeing’s facility will enable it increase its throughput and work on larger constellations

“I’m not going to put a number on it,” Kim said, when asked about the company’s projected production rates once the floor is up and running. “We’re modular and flexible, and we can meet the different customers’ demand.”

Along with a new pulse production line, which means parts move sequentially through a series of work stations, the new facility will have an integration and test space as well as a feeder line where Millennium will develop its dual-use satellite products, including batteries, software-defined radios, flight computers and star trackers.

The process, Kim said, is similar to that of a company developing a concept car or aircraft, proving it works and then putting it into production.

“We’re building the prototypes and the prototype small constellations,” he said. “Once it’s all wrung out and we launch those, we will transition seamlessly here to build them in a very, very large constellation fashion.”

Lockheed Martin is also making adjustments to accommodate significant growth in small satellite production at its Waterton Campus in Littleton, Colo. The company is on contract to build 52 satellites across the first two phases of the SDA’s Transport Layer — which will create an on-orbit mesh network in LEO to connect space-based sensors with shooters on the ground — and is anticipating more small satellite business in the future.

Lockheed is currently assembling the SDA space vehicles on the same floor where it builds satellites for the Space Force’s GPS and Next-Generation OPIR systems, but as it incrementally scales up its SDA production line, it’s making plans to expand and shift that work into another facility on its campus in the next year.

Erik Daehler, Lockheed’s protected communications mission area lead, told C4ISRNET in a recent interview that the new production space will accommodate future orders from SDA as well as other customers.

“We have multiple customers asking for satellites in this class and this production scale,” Daehler said. “This will become the heart of that production system, but we’ll be delivering satellites like this in the long term.”

Kristin Robertson, president of space and command and control systems for Raytheon Intelligence and Space, says having a diverse, vertically integrated portfolio is key to responding to customer demands. Raytheon in 2020 bought Blue Canyon Technologies, a small satellite company, and then last November completed its acquisition of SEAKR Engineering, a space electronics provider.

Speaking with C4ISRNET in a recent interview, Robertson was hesitant to project future production quantities, but said the company is prepared to increase its capacity as needed.

“We’re investing to grow, because the market and the demand signal is there,” she said.

Small-satellite demand has also driven changes at L3Harris, a company traditionally known for its space technology development. In recent years, the company has been building up its manufacturing capacity and last year announced it would expand its facility in Melbourne, Fla., and increase its production throughput to six satellites per month.

That increased capacity makes room for development and testing of the Air Force Research Laboratory’s experimental positioning, navigation and timing satellite, NTS-3 — which could be part of a future hybrid PNT architecture — as well as the company’s missile tracking work for SDA and the Missile Defense Agency.

Tim Lynch, vice president of the space and airborne segment at L3Harris, told C4ISRNET the investment in those facilities has paid off for the company, preparing it to respond to Department of Defense and intelligence community needs. He said he projects the company will build between 75 and 100 satellites over the next three to five years.

“The architectures are all pointing towards multiple satellites in multiple different orbits, which plays directly into where we’ve invested very strongly over the last five years,” Lynch said. “Our internal research and development is really focused on how do you build exquisite capability at an affordable price and how do you package that in a small volume so that you can launch a lot of satellites at one time.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.