WASHINGTON — Then-Defense Secretary Jim Mattis had a question for Mike Brown before he took over the Pentagon’s Silicon Valley outreach arm: What can you do that helps grow the military’s capabilities?

It’s a question that the Defense Innovation Unit was created in 2015 to solve, born from concerns about growing threats from China and Russia and the need to reap the benefits of innovative technology that traditional primes couldn’t provide.

“I thought: ‘That’s an awfully daunting task,’” Brown recounted in a December 2020 interview with Defense News.

Now, as President Joe Biden’s nominee to become the Pentagon’s top weapons buyer, Brown faces that same task on a far larger scale than DIU’s $67 million research and development budget. He is poised to gain authority over about $400 billion in acquisition and sustainment spending. In doing so, he would have an “existential” imperative, according to several defense experts, to bring in the latest technology from first-time contractors for artificial intelligence, weapons software and hypersonic technology to counter China. And he would need to reform the levers of purchasing power that impede nontraditional contractors from working with the agency.

This would mean navigating a budget planned years in advance that is too slow for startups that need capital to stay afloat, while revamping a cumbersome competitive process that favors megacorporations without alienating primes.

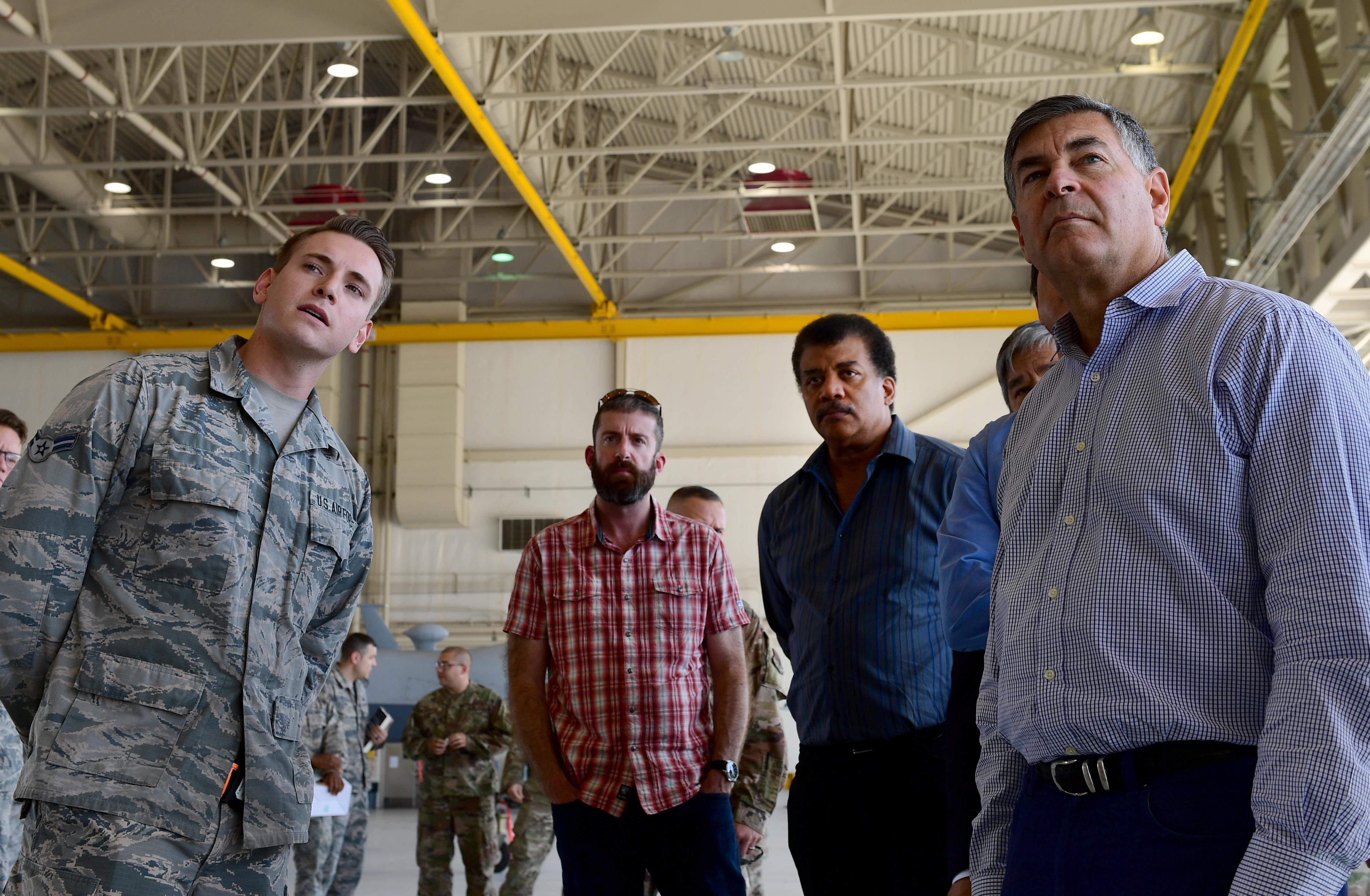

On a smaller scale, Brown put those changes in motion at DIU, taking to heart Mattis’ comments when selecting projects and making changes. Under Brown’s direction, DIU reduced the time between closing solicitations and signing contracts, while using other transaction authorities — a flexible acquisition tool — to begin prototyping. By doing so, DIU connected services and combatant commands with innovative companies that provide technology for predictive maintenance, automated cybersecurity, small drones and more.

DIU increased its industry responses to proposals by 50 percent in the last year and transitioned 11 prototyping projects to Department of Defense partners in 2020, up from four in 2018, including an AI-enabled air threat response tool that transitioned to the North American Aerospace Defense Command. It starts an increasing number of projects every year, with more than half of awardees categorized as nontraditional vendors and 34 percent as first-time vendors.

RELATED

With an industry background, Brown’s promotion from DIU to the DoD’s leading acquisitions office would be the “next logical step” to improve the department’s purchasing of top-tier technology, said Chris Brose, chief strategy officer at defense tech firm Anduril Industries.

“This has to be systemic disruption. DIU has been important in laying the seeds for many promising capabilities in that regard, but it’s got to get to scale,” Brose said. An urgent, rapid technology expansion should be Brown’s focus if confirmed by the Senate “because if we don’t do this, then we will fall behind, we will be surpassed.”

As of press time, the Senate Armed Services Committee had not scheduled a confirmation hearing.

As undersecretary of defense for acquisition and sustainment, Brown would be up against a monstrous bureaucracy that has made minimal progress accommodating producers of the latest technologies despite recognizing its shortfalls since the 1980s. And his portfolio would be filled with potential hindrances: troubled acquisition programs, supply chains with cybersecurity concerns, slow budget cycles and arcane purchasing processes.

“There will be a line out the door of urgent things that people want done across the enterprise right now,” Brose said.

A nontraditional start in industry

Brown doesn’t have an extensive national security or defense industry background like some top Pentagon officials. He joined government in 2016 after a career in the tech sector, capped by a two-year stint as CEO of cybersecurity software giant Symantec.

As the Pentagon shifts its focus to digital warfare, his understanding of small, innovative companies and government requirements positions him to reform processes that slow the Pentagon’s access to competitive technologies.

“It’s invaluable to have someone with industry experience being inside of the government, understanding the government requirements, demands and needs, yet understanding the environment in which industry is operating,” said Ellen Lord, undersecretary of defense for acquisition and sustainment during the Trump administration. “I think that Mike’s operational experience and know-how will serve him very well, serve DoD very well and serve the administration very well.”

Lord’s comments reflect the consensus among experts interviewed that Brown is well qualified and understands the necessity for the Pentagon’s bureaucracy to ditch the status quo and place big bets on future-defining technologies to compete with China. Brown declined an interview for this story.

One key market where DIU contributed a solution to counter Chinese-made suppliers was small drones. After Congress banned federal entities from buying foreign-made small drones because of security concerns, DIU partnered with the Army to develop small reconnaissance drones, eventually making secure drones from five companies available across the federal government.

“A lot of his role was making connections [and] getting the right industry partner connected to the right part of the Department of Defense,” said Mark Lewis, executive director of the Emerging Technologies Institute at the National Defense Industrial Association and former acting deputy undersecretary of defense for researching and engineering, an office that oversees DIU. “That skill set is going to be absolutely critical in his role in A&S.”

However, Brown’s nomination faces uncertainty after Defense One reported in April that the DoD inspector general was probing a complaint accusing Brown of circumventing federal hiring laws to hand-pick employees. That complaint, from DIU’s former chief financial officer, alleged that some applicants received special treatment. As of press time, the inspector general had not publicly announced an investigation into Brown.

The Senate has not acted on Brown’s nomination since it arrived from the president on April 12, a significant lag that observers attribute to the allegation. Brown’s nomination appears frozen: The Senate has confirmed several other Pentagon nominees.

“This is a very standard situation for someone that has had allegations/investigations,” said Arnold Punaro, a former SASC staff director and current National Defense Industrial Association board chairman. “Over the years, whenever there’s a situation like that — whether it’s an active-duty military civilian — the committee waits until they get the final determination from the executive branch. ... They don’t act on the person who’s got the ongoing review, and 99.9 percent of the time it’s just cleared up, and I believe that will be the case with Mike Brown.”

Punaro said he is bullish on Brown’s chances of confirmation and said Brown’s background makes him “a perfect fit for the job.” Still, the allegation is an open question, and even if the issue was cleared up soon, it’s unclear how quickly the Senate could squeeze Brown into its crowded agenda.

If confirmed, Brown’s understanding of the threats posed by China’s technological advancements would likely shape his approach to the A&S job. At DIU, he co-authored a startling 2018 study that detailed how China participated in the U.S. venture capital ecosystem to access innovative technologies. That report laid out future capabilities that China views as critical: AI, robotics, autonomous vehicles, and augmented and virtual reality, among others. “What is at risk for the U.S. is not only losing an edge in the foundational technology, but also in successive generations of applications and products that the foundational technology enables,” he wrote.

RELATED

To counter China, Brown has said, the Pentagon must connect with U.S. companies innovating in those areas, fostering market conditions that expand the defense industrial base. “We need to think about how do we work in their world — not ask them to conform to ours. If we ask companies to conform to the way we work, you get primes,” Brown said in the December interview. “We need more capability than those companies can offer.”

From his time at DIU, experts expect Brown would be an effective communicator because of his grasp of smaller companies’ acquisition hurdles. “Understanding what those barriers are to those types of companies, Brown will get from coming from DIU, and frankly, from his commercial background … a huge, huge positive for that position,” said Bill Greenwalt, deputy undersecretary of defense for industrial policy under the George W. Bush administration and an American Enterprise Institute visiting fellow.

R&D and risk-taking to counter China

Brown would have a role in shaping how the Pentagon counters China’s approach to technology development, called civil-military fusion.

He has expressed concern that the Chinese government’s strategy to break down barriers between civilian research and its defense sector provides it with an “unfair advantage.” But he acknowledged the approach has lessons for the U.S., including its long-term strategic planning, science and technology investment, and close connection between industry and the military.

“We’ve got to basically address that by providing incentives, not by fiat,” Brown said in the earlier interview. “I don’t want its system, but we both see that probably has some advantages in getting things done more quickly.”

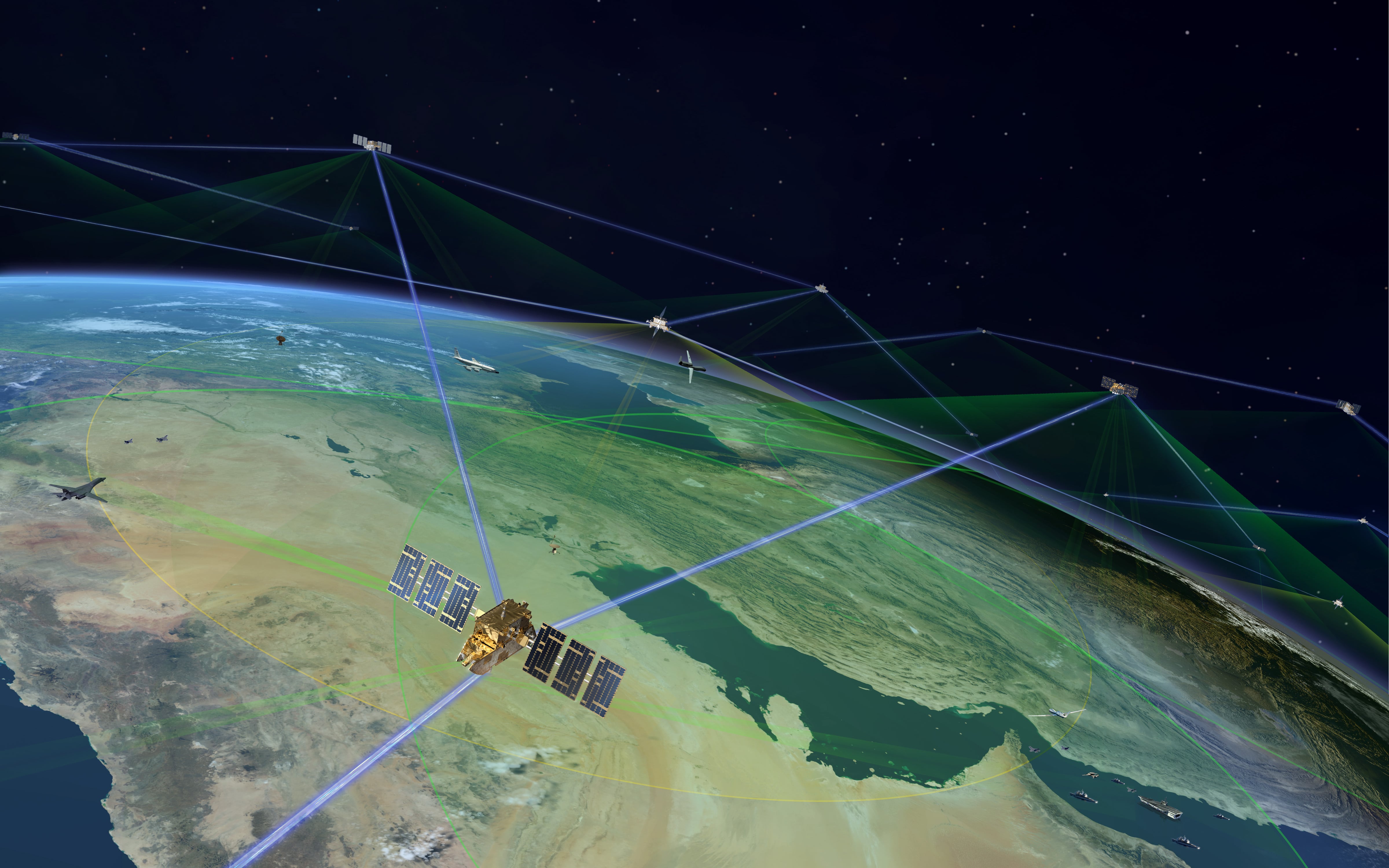

One priority for China is semiconductors, which Brown has called one of his “favorite” technologies and might prioritize, after Lord started an effort to entice microchip manufacturing back to the U.S. The microelectronic supply chain crisscrosses the globe, posing security threats, but the DoD needs chips for nearly all military technology, from AI to satellites to F-35 jets.

RELATED

During the pandemic, DIU released a report on the fragility of the space industrial base, perhaps foreshadowing a priority for him, if confirmed.

“We need to make sure our vendor base, which is not protected by the government like [China’s], is [protected],” Brown said in the interview last year. “We have [to have] that be very vibrant if we want to benefit ... from all of the innovation that happens and obviously the lower cost that comes from folks pursuing commercial opportunities.”

Under Lord’s tenure, the Pentagon launched software acquisition regulations to quicken purchasing. She said Brown should pick two or three “pathfinder” projects and build existing work to create flexible acquisition processes.

And while the department must transform acquisitions, Brown has stated industry must reform its culture. In a 2020 paper for the Brookings Institution, he wrote that industry’s short-term focus on quarterly results over long-term R&D hurts American competitiveness in areas including AI, quantum computing and semiconductors.

Breaking down the wall that hinders the Pentagon and new tech companies from doing business is a crucial tenant of future American military superiority.

“This is the singular greatest question that we have to face. We’ve built a defense enterprise over 30 years that’s almost impervious to disruption,” Brose said. “We have to be able to generate disruption at scale.”

Aaron Mehta and Joe Gould contributed to this report.

Andrew Eversden covers all things defense technology for C4ISRNET. He previously reported on federal IT and cybersecurity for Federal Times and Fifth Domain, and worked as a congressional reporting fellow for the Texas Tribune. He was also a Washington intern for the Durango Herald. Andrew is a graduate of American University.