WASHINGTON — The Defense Advanced Research Projects Agency said it plans to award a contract next summer to establish a U.S. hub for advanced microelectronics manufacturing.

The program, dubbed Next-Generation Microelectronics Manufacturing, will fund the research and equipment to create a domestic center for prototyping cutting-edge fabrication techniques, which DARPA hopes will give the U.S. semiconductor industrial base a leading edge. The goal is to stand up the capability by 2029.

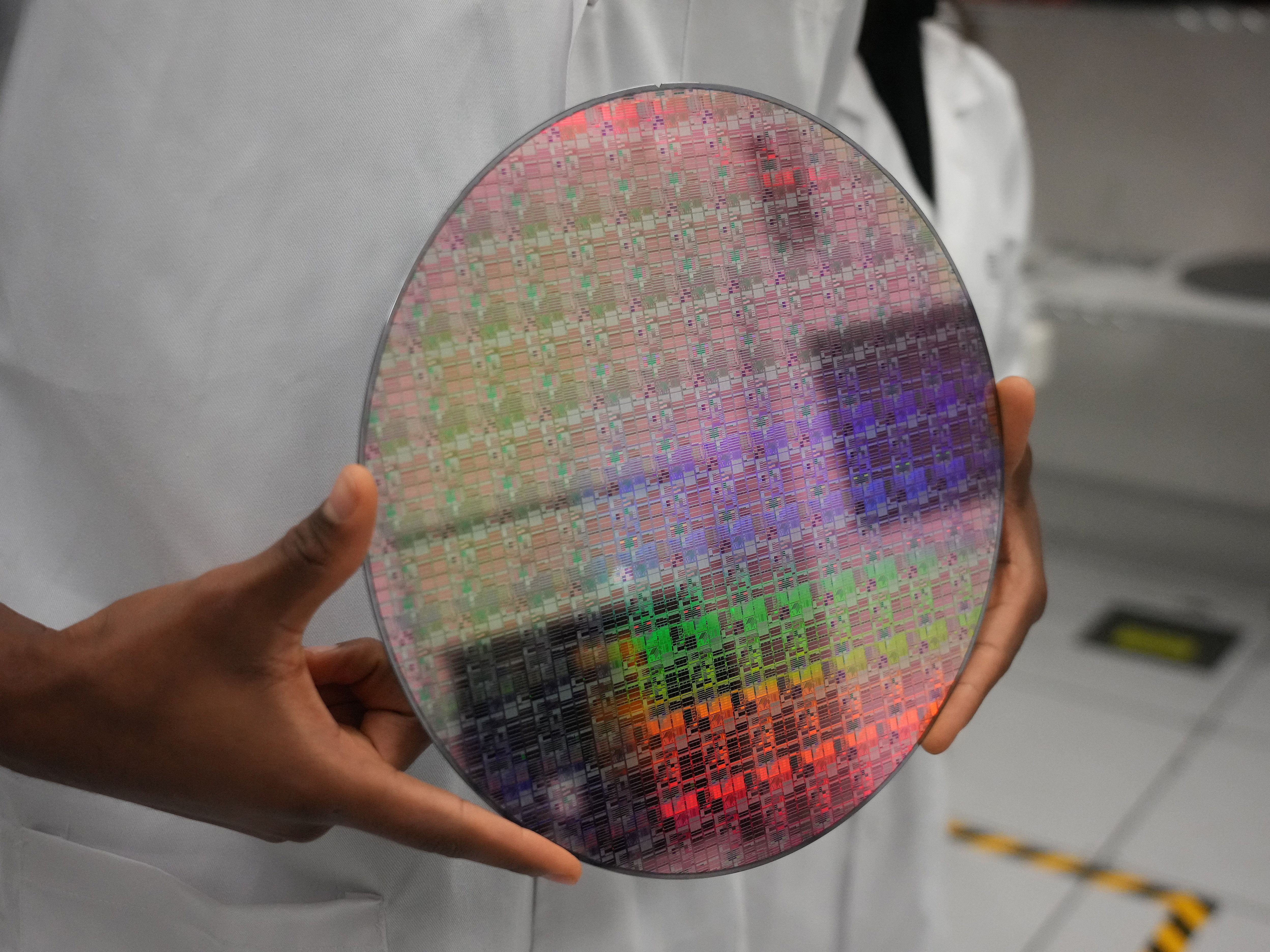

The center will focus on 3D heterogeneously integrated microsystems, or 3DHI – an advanced approach to microelectronics fabrication. The premise of 3DHI research is that by integrating and packaging chip components differently, manufacturers could disaggregate functions like memory and processing to significantly improve performance.

It’s a technology area that could not only transform the U.S. industrial base, but that other nations, including Taiwan — the global leader in microelectronics production — have a strong interest in.

“Presently, the U.S. has no open-access manufacturing center with comprehensive capacity for 3DHI research and development,” DARPA said in a Nov. 20 program announcement. “Anticipating that the next major wave of microelectronics innovation will come from the ability to integrate heterogeneous materials, devices, and circuits through advanced packaging, DARPA proposes to stand up a national accelerator specifically for next-generation 3DHI.”

In July, the agency chose 11 teams to begin the foundational work for the center. DARPA said this week it plans to select a single team for the next two phases of the program, with awards for each phase worth up to $420 million.

Under the partnership, known as an other transaction agreement, the selected team would also fund a portion of the work. DARPA plans to brief industry on the effort Nov. 28.

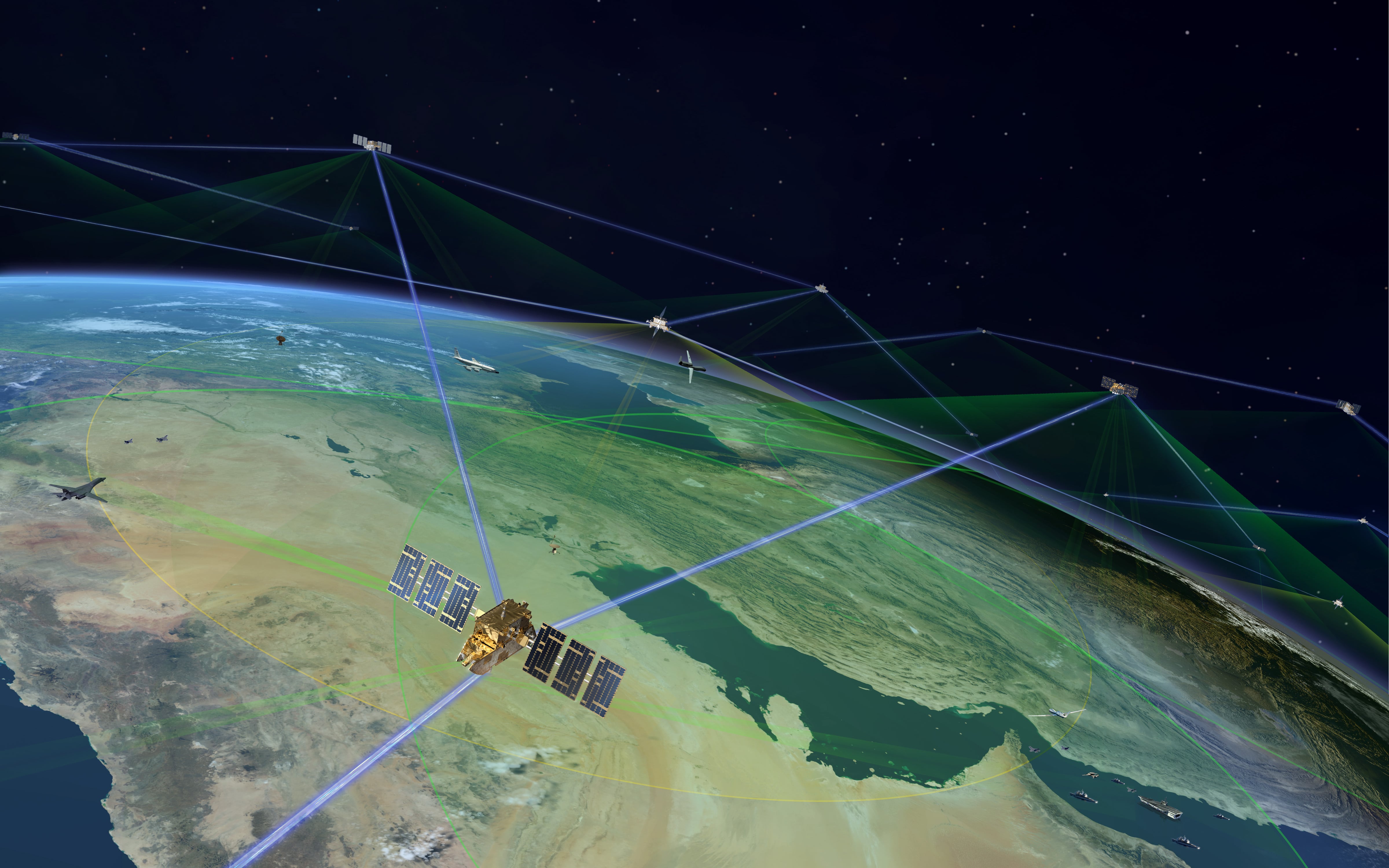

The U.S. imports a large portion of its advanced semiconductors from Taiwan and China, who dominate the global market. Concern has grown in recent years about an over reliance on foreign supply chains for these critical microsystems, which power cars, cellphones and major Defense Department weapons.

DARPA’s focus on forward-looking technologies through efforts like NGMM and is distinct from a broader U.S. government effort to boost today’s domestic semiconductor industrial base through the Creating Helpful Incentives to Produce Semiconductors, or CHIPS Act. The measure, which Congress passed in 2022, runs through 2026 and funds semiconductor workforce improvement efforts, research and development and manufacturing. It also provides a 25% tax credit for investments in domestic manufacturing facilities and equipment.

While the CHIPS Act is focused on shoring up the U.S. supply base in the near-term, DARPA’s efforts in this area are geared toward “the next wave of innovation.”

NGMM, the centerpiece of those efforts, falls under the umbrella of the agency’s Electronics Resurgence Initiative 2.0, which aims to address technological challenges that affect U.S. national security and commercial industry.

Phase 1 of NGMM will focus on buying equipment, creating foundational fabrication processes and establishing automation and simulation software that’s tailored to 3DHI systems. Phase 2 is centered on creating hardware prototypes, automating processes, and developing emulation capabilities.

“The end goal of the program is to establish a self-sustaining 3DHI manufacturing center at an existing facility that is owned and operated by a non-federal entity, and accessible to users in academia, government, and industry,” DARPA said. “Success will be measured by the ability to support the design, fabrication, assembly, and test of a wide range of high-performance 3DHI microsystems at reasonable cost with cycle times supporting fast-paced innovative research.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.