The Department of Defense could be looking to spend on a tech refresh, communications and recruiting unmanned systems pilots even though the rest of the C4ISR budget will see modest growth, according to budget forecasters.

Budgets should be on slight increases as they emerge from the troughs of sequester cuts of 2013-2015, said Cyndi Thomas, Professional Services Council vision speaker, at PSC's Vision Conference on Nov. 19.

Intelligence and computers spending is projected to grow at least 3 percent over the next decade while communications could grow 5 percent, driven by the $430 million Joint Tactical Radio System procurement expected between fiscal 2016 and fiscal 2017.

FREE WEBCAST: Satcom for Secure Voice, Video and Data on the Battlefield

"The growth in the communications section occurs over a longer growth of time," she said. "It is largely due to the [general packet radio service] program for the HMS portion of that — the Handheld, Manpack and Small Form Fit — procurement."

Thomas said the HMS program, which should be moving forward in 2017, and the Navy's Jammer program would help drive communications spending up through 2019.

A DoD computer upgrade over the next four years could also result in better tech procurement for contractors looking to supply the Marine Corps, Thomas said.

"We've got a fairly decent chunk of growth here that is occurring from 2015 to 2019," she said. "That is related to the Marine Corps common hardware sweep. It's gearing up for a tech refresh and is purchasing all of the hardware for all of the non-[Navy Marine Corps Intranet] users."

That means a $366 million bump in procurement to help bolster the computers budget from $2.3 billion in 2015 to a projected $2.9 billion by 2019.

Command and control spending could increase to $290 million in fiscal 2016 before a slowdown in 2018 as Phase 1 of the Army's Global Combat Support System enhancements come to a close.

Thomas and a team of analysts also focused their economic forecasts on three capability areas that could impact C4ISR in the near future: unmanned systems, space and the convergence of cyber, electronic warfare and spectrum.

The increased demand for unmanned missions has left a pilot shortage that could be filled with contractors. Thomas also said the future of unmanned systems includes the need for smaller physical and fiscal footprints, as newer models will seek to address energy and endurance challenges. Opportunities for data compression and onboard analytics to help crunch the data will also be popular.

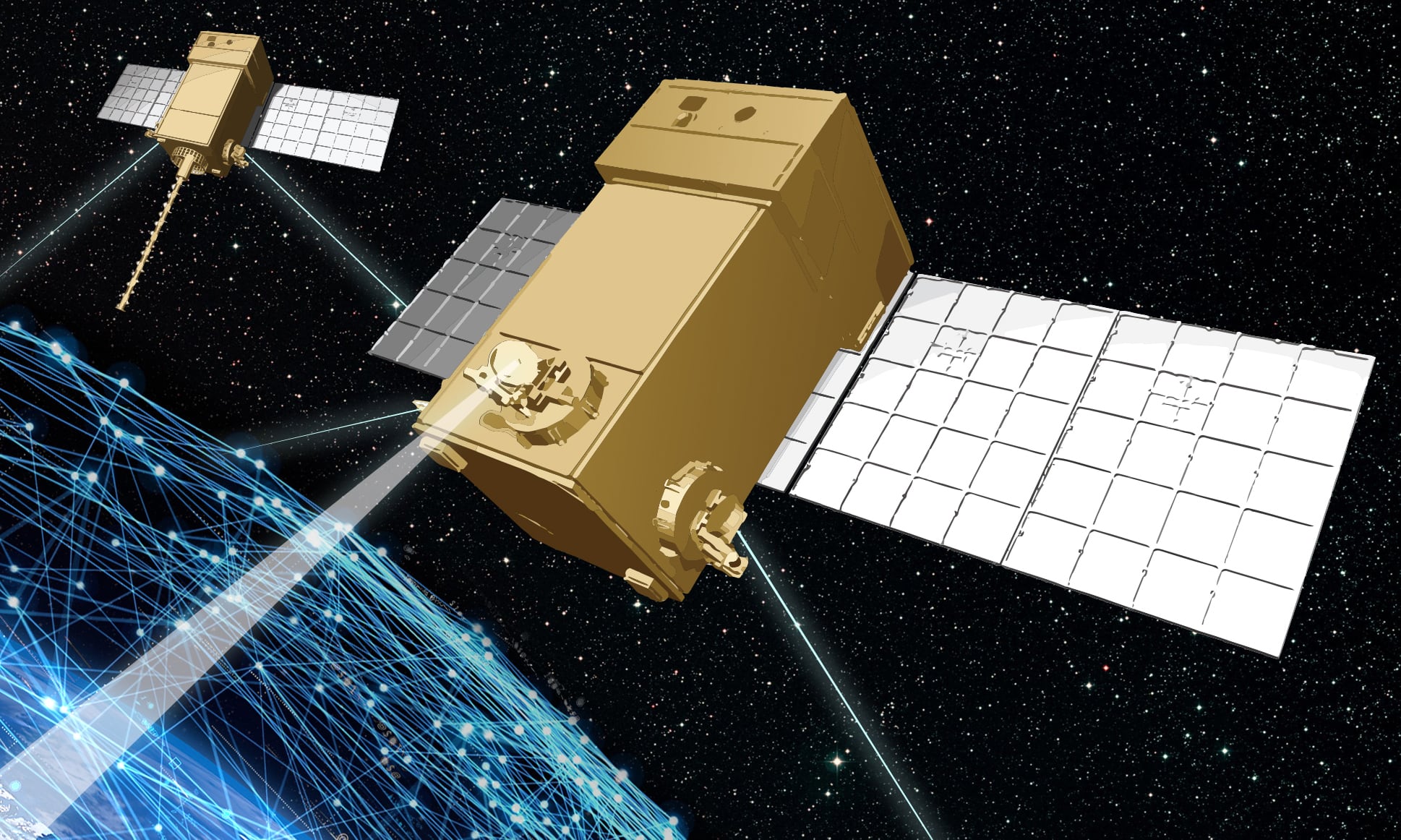

Space is also fast becoming a key piece of infrastructure to be defended. Thomas said that the dependence on satellite-based communications and navigation systems means that defense systems in space will become more integral.

"Renewed attention to this domain, and noticing our reliance upon GPS and visual information, has really identified an alarming vulnerability in our C2 and communications controls that must be addressed," she said.

Overhead Persistent Infrared improvements as well as resiliency for satellites and threat detection, mean more advancements for space capabilities, but an expansion of competition could provide a blend of positives — opportunities for entrepreneurs wanting to enter the market -- and threats — new, smaller, maneuverable assets up against aging, static, technically vulnerable systems.

She added that defense officials would now shift their gaze from "needing space to surveil to needing to surveil space."

Cyber warfare is also a new battlefield for the DoD, and the forecast for future development includes signals intelligence advancements, detection and protection capabilities as more institutions are breached.

"What's happened now with the emergence of our wireless world is we are engaging more directly in asymmetrical warfare where everyone and everything is now a target," Thomas said.

She said that protection systems and attack capabilities will have to be advanced as adversaries attack more online. This includes transcending frequency limitations to transmit more info over both higher and lower spectra.

Moving forward, the forecast calls to more collaboration to navigate slimmer budgets, but also a focus on interoperability, data analytics and spectrum optimization to address core security needs.